- EURO STOXX 50 sentiment fell to low of 92 points in March

- Banking sector fears affected retail investors’ trust in European stocks

- Trading volume growth suggests retail investor interest despite negative sentiment

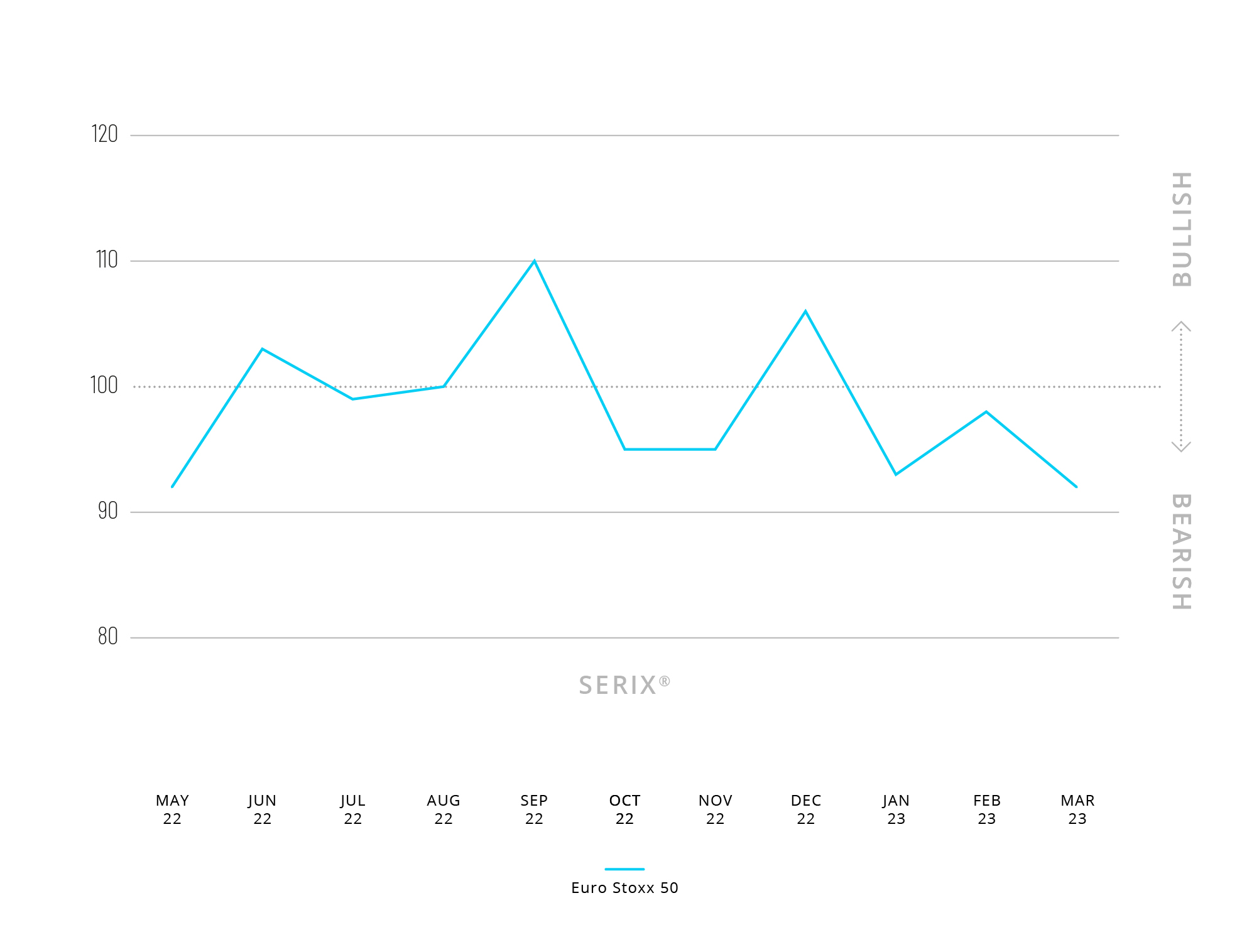

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX® sentiment data for European retail investors for March, revealing retail investor sentiment towards the EURO STOXX 50 sunk last month, hitting 92. The SERIX® value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

“The EURO STOXX 50 comprises European companies across a range of industries, not just financial businesses, and the response from retail investors to this broader index suggests a fear of contagion to other sectors as bad news from the banking sector gathered steam,” explains Michael Hall, Head of Distribution at Spectrum.

The index contains several leading European financial institutions, including: Allianz, AXA, Banco Santander, BNP Paribas, Deutsche Börse, ING, Intesa Sanpaolo and Munich Re. The volume of trading on derivatives linked to EURO STOXX 50 increased, along with other key underlyings, last month as the Silicon Valley Bank and Credit Suisse stories unfolded and market volatility rose.

“Last month we saw trading volumes on Spectrum increase as market uncertainty, and associated volatility, brought on by major events such as the energy crisis, inflation and banking fears, created opportunities for retail investors. And it doesn’t come as a big surprise to see a preference for the bearish trades over bullish, considering the macro environment”, says Michael Hall.

In March 2023, 160.7 million securitised derivatives were traded on Spectrum, with 34% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

84.3% of the traded derivatives were on indices, 4.5% on commodities, 10.2% on currency pairs, 0.8% on equities and 0.2% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (29.8%), S&P 500 (25.7%), and NASDAQ 100 (15.7%).

Looking at the SERIX® data for the top three underlying markets, the DAX 40 remained bearish at 98, the S&P 500 swayed from a bullish 101 to a bearish sentiment of 99, and the NASDAQ 100 shifted from a neutral 100 to a bearish 98.

Calculating SERIX® data

The Spectrum European Retail Investor Index (SERIX®), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX® = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

About Spectrum Markets

Spectrum Markets is the trading name of Spectrum MTF Operator GmbH. Headquartered in Frankfurt am Main, Germany, it is a pan-European trading venue for securitised derivatives aimed at financial institutions and their retail investors. Since launch, trading has been available in: Germany, France, Italy, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, the exchange uses a uniquely open architecture system to allow investors to trade with increased choice, control and stability. Through its pan-European ISIN, 24/5 trading services and its own proprietary venue, Spectrum enables a guaranteed baseline level of liquidity over a range of products and is able to swiftly and safely match a significant number of orders and process multiple quotes every second.

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcommunications.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.