- SERIX® sentiment on safe-haven asset gold fell to all-time-low of 93 points in January

- Record high of 173 million securitised derivatives traded on Spectrum in January

- ECB’s key interest rate increase likely to have been a driver of trading linked to gold

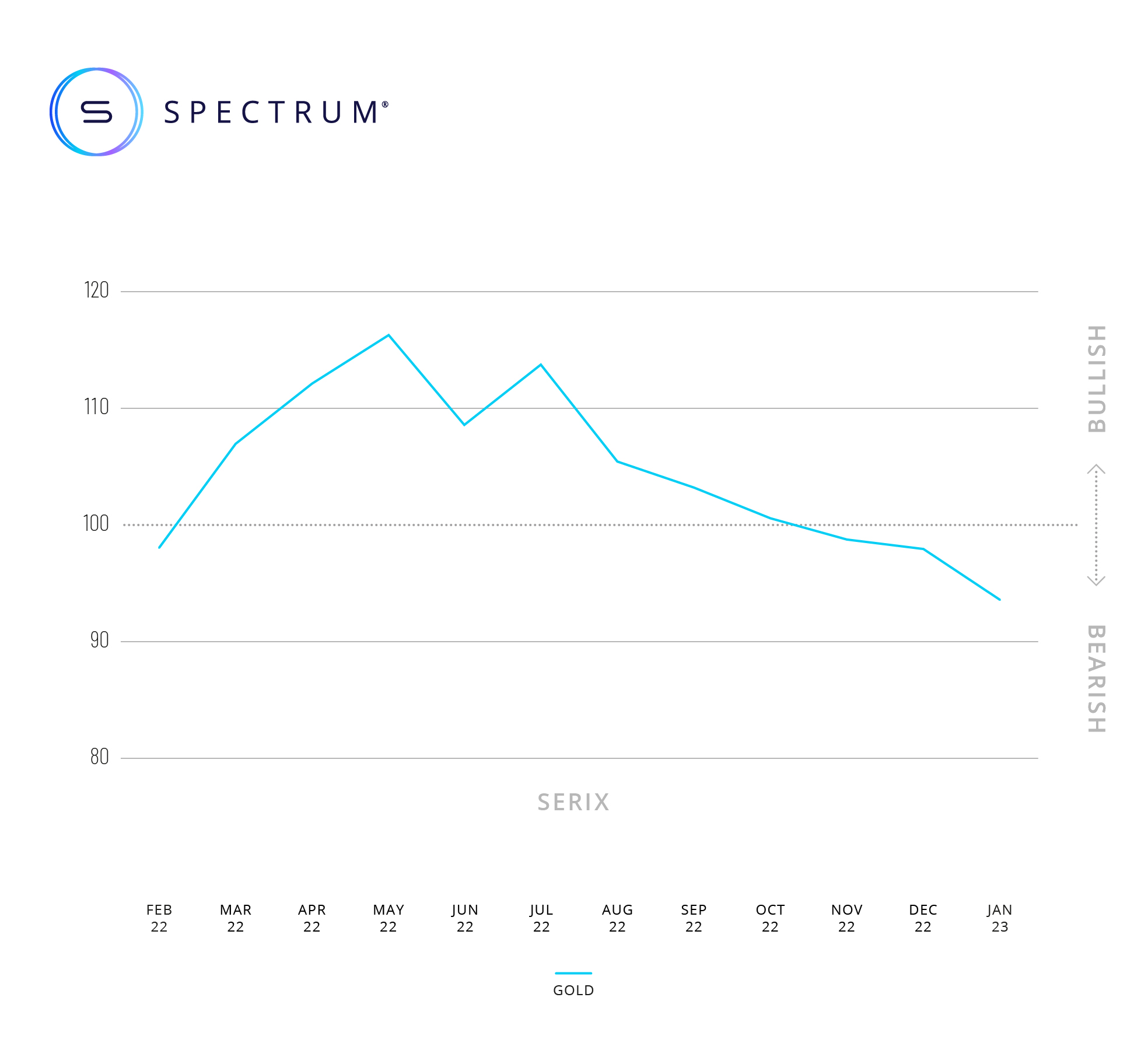

Spectrum Markets (“Spectrum”), the pan-European trading venue for securitised derivatives, has published its SERIX® sentiment data for European retail investors for January 2023, revealing a record low sentiment for gold. The SERIX® value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

"We’ve seen the SERIX® indicator on gold decline steadily since summer last year, with trading activity related to the precious metal, which tends to be used to be a safe haven in time of crisis and economic uncertainty, driving sentiment down to a record level of 93 points for the first time in SERIX® history,” says Michael Hall, Head of Distribution at Spectrum Markets.

Previously the SERIX® sentiment on gold peaked at 116 in the lead up to summer 2022, against the backdrop of the Russian invasion of Ukraine. Historically its popularity tends to be closely linked to investor expectations of riskier markets.

However, in the second half of last year several events have painted a different picture. Ukrainian forces have recently regained their strength and confidence, and the western world, especially Europe, seems to be more united than ever before, not only politically, but also economically.

ECB’s decisions on monetary policy contributed to a drop in Euro inflation to 8.6% recently, after it hit a record high of 10.6% in October 2022. The ECB raised key interest rate from zero in July 2022 up to 3%1 , making interest rate-related investments, such as bonds, more attractive after a long dry period, which diverted investor attention away from the likes of gold.

Additionally, China’s economy regained some of its strength and is starting to recover following a prolonged Covid-19 lockdown.

“Although some experts have been quick to describe the Davos optimism as premature, retail investors seem to be embracing a more positive outlook, as reflected in their increasingly bearish sentiment towards gold, the benchmark safe-haven asset”, says Michael Hall.

In January 2023, a record high of 173 million securitised derivatives were traded on Spectrum, with 33.7% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

83% of the traded derivatives were on indices, 9.4% on commodities, 6.3% on currency pairs, 1.2% on equities and 0.1% on cryptocurrencies, with the top three traded underlying markets being NASDAQ 100 (26.5%), DAX 40 (23.4%) and S&P 500 (14.8%).

Looking at the SERIX® data for the top three underlying markets, the NASDAQ 100 shifted from a bullish 103 to a bearish 99, the DAX 40 shifted from a neutral 100 to a bearish 96 and the S&P 500 swayed from a bullish sentiment of 103 to a bearish 94.

Calculating SERIX® data

The Spectrum European Retail Investor Index (SERIX®), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX® = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

About Spectrum Markets

Spectrum Markets is the trading name of Spectrum MTF Operator GmbH. Headquartered in Frankfurt am Main, Germany, it is a pan-European trading venue for securitised derivatives aimed at financial institutions and their retail investors. Since launch, trading has been available in: Germany, France, Italy, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, the exchange uses a uniquely open architecture system to allow investors to trade with increased choice, control and stability. Through its pan-European ISIN, 24/5 trading services and its own proprietary venue, Spectrum enables a guaranteed baseline level of liquidity over a range of products and is able to swiftly and safely match a significant number of orders and process multiple quotes every second.

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcommunications.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

1. https://www.ecb.europa.eu/stats/policy_and_exchange_rates/key_ecb_interest_rates/html/index.en.html