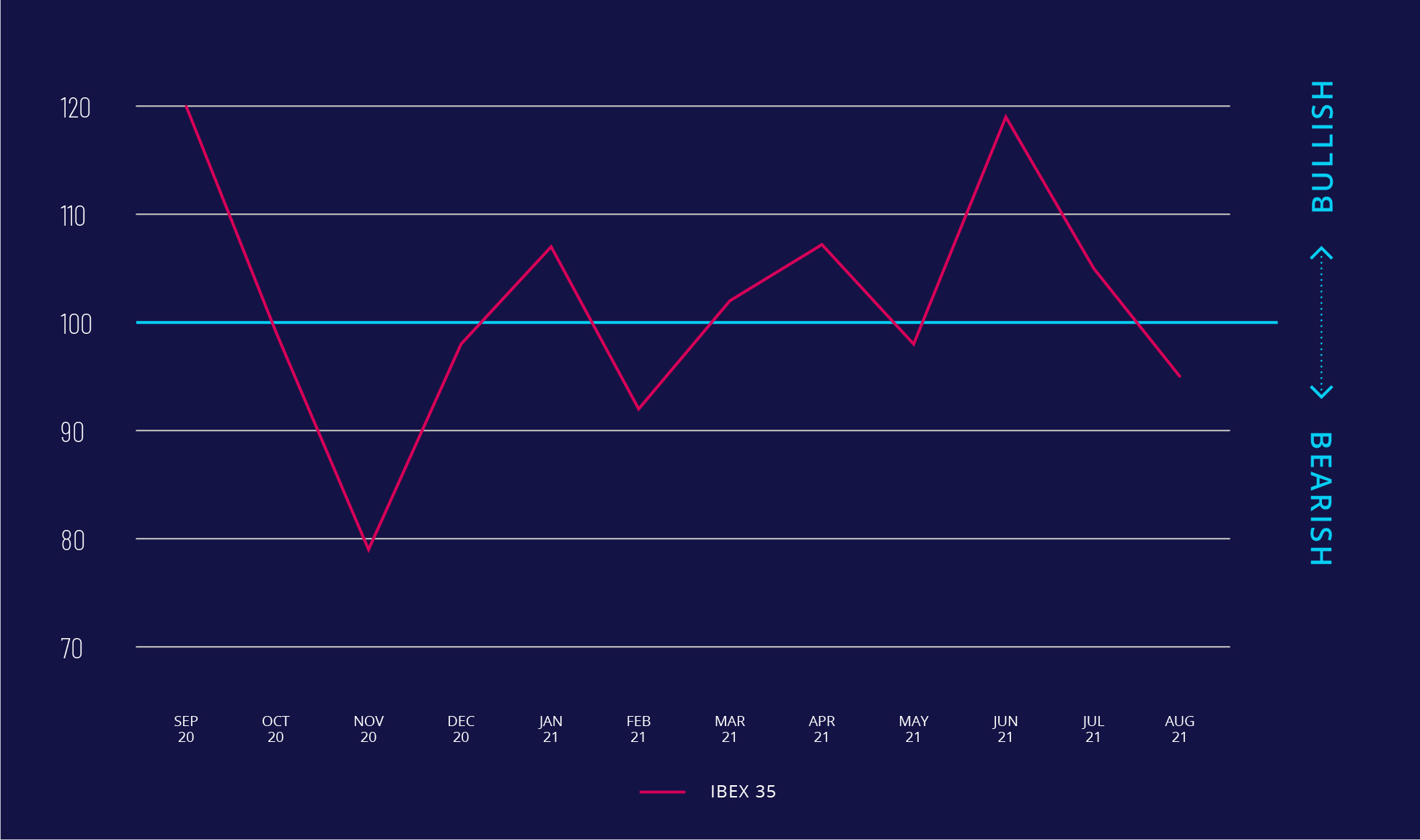

• IBEX 35 sentiment declines further, dropping into bearish territory

• Significant drop could trigger further selling on the Spanish index

• 60 million securitised derivatives were traded on Spectrum last month

Spectrum Markets, the pan-European trading venue for securitised derivatives, has published its SERIX European retail investor sentiment data for August (see below for more information on methodology), and notes the continuation of significant bearish trading related to Spain’s IBEX 35 index.

After dropping from a nine-month high in June to 105 in July, retail investor sentiment on the IBEX 35 fell further in August to reach a bearish SERIX value of 95. This came as international investors contemplated the twin pressures of rising COVID-19 infections and the rapidly deteriorating situation in Afghanistan.

“Though the rate of new Spanish COVID-19 cases looked to be slowing into August, the IBEX 35 has struggled to maintain the upward trend it started in mid-July, and the SERIX data suggests retail investors are starting to get a bit nervous,” notes Thibault Gobert, Head of Liquidity Pool at Spectrum Markets.

“If the IBEX 35 experiences another significant decline, like the one seen in the second half of June, this could trigger further selling and, looking at the clear bearish signals we are seeing in our data, retail investors seem to be preparing for this scenario either by taking profits or positioning themselves for a drop in the near term.”

During August, 60 million securitised derivatives were traded on Spectrum, with 33.1% of trades taking place outside of traditional hours (i.e. between 17:30 and 9:00 CET). 80.4% of the traded derivatives was on indices, 10% on currency pairs, and 9.6% on commodities, with the top three traded underlying markets being DAX 30 (27%), NASDAQ 100 (16.7%) and OMX 30 (13%).

Looking at the SERIX data for the top three underlying markets, the DAX 30 moved back into bearish territory, dropping from 101 to 99 while the NASDAQ 100 also dropped two points, to 96. Meanwhile the OMX 30 recovered some of the bullish momentum seen earlier this year, rising from 92 to 99 in August.

Calculating SERIX data

The Spectrum European Retail Investor Index (SERIX), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

About Spectrum Markets

Spectrum Markets is the trading name of Spectrum MTF Operator GmbH. Headquartered in Frankfurt am Main, Germany, it is a pan-European trading venue for securitised derivatives aimed at financial institutions and their retail investors. Since launch, trading has been available in: Germany, France, Italy, Spain, Sweden, Norway, the Netherlands, Ireland, and Finland.

Regulated by BaFin and MiFID II compliant, the exchange uses a uniquely open architecture system to allow investors to trade with increased choice, control and stability. Through its pan-European ISIN, 24/5 trading services and its own proprietary venue, Spectrum enables a guaranteed baseline level of liquidity over a range of products and is able to swiftly and safely match a significant number of orders and process multiple quotes every second.

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcommunications.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitized derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Turbo Warrants are complex financial instruments and investors may experience a total loss.