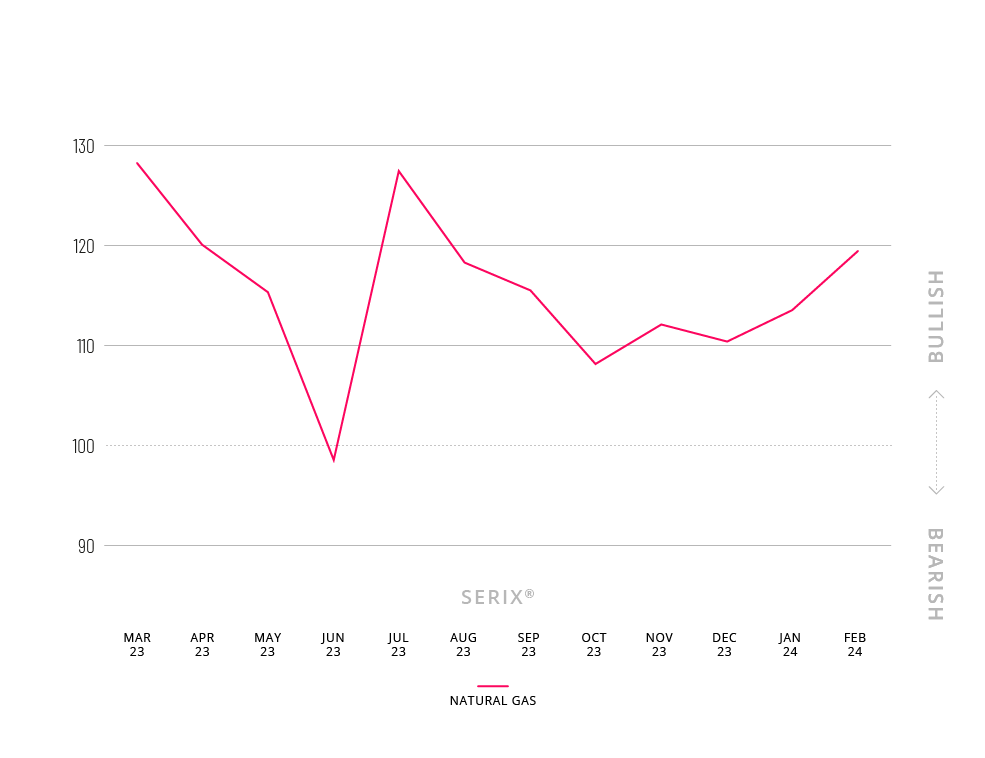

- Spectrum's SERIX® sentiment indicator for natural gas reached 119 points

- Sentiment suggests European retail investors were anticipating upward movement in gas prices as supply-demand dynamics evolved

- Europe's efforts to reduce dependence on Russian energy could present opportunities for the natural gas sector

Spectrum Markets (“Spectrum”), the pan-European trading venue for securities, has published its SERIX® sentiment data for European retail investors for February, revealing increasingly bullish trading behaviour linked to natural gas.

Since mid-January, the price of natural gas has experienced a decline, although there has been considerable volatility. After peaking in 2022 at around $10, the price has since been falling in 2023 and has rarely exceeded $2.

Spectrum Markets made instruments on natural gas available in March 2023, in response to investor demand, and it has seen bullish SERIX® sentiment for all but one of the months since then, reaching 119 points in February 2024.

The SERIX® value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion

“There are several reasons why the natural gas price has fallen since the beginning of the year. Among the factors are the attempts to diversify energy sources as a means of reducing emissions, as well as a decreasing domestic demand and high inventories resulting from a mild winter, coupled with a high production volume”, says Michael Hall, Head of Distribution at Spectrum Markets.

“However, from a European perspective there is a different view on this: Investors are noting a stable demand for LNG gas deliveries and observing increasing LNG shipments from the United States to European ports due to Europe’s efforts to reduce dependence on Russian natural gas supplies. According to the Council of the European Union, the EU is already the largest LNG importer in the world. The ongoing conflict has prompted EU member states to further develop their LNG infrastructure and import capacity. That is why retail investors have tried to capitalise on the currently low price and took a long position on natural gas”, adds Michael Hall.

Spectrum’s February data

In February 2024, order book turnover on Spectrum was €213.6 million, with 34.5% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

80.8% of the order book turnover was on indices, 4.5% on currency pairs, 6.6% on commodities, 5% on equities and 3.1% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (30.7%), NASDAQ 100 (23.7%), and DOW 30 (10.1%).

Looking at the SERIX® data for the top three underlying markets, the DAX 40 sentiment dropped from 99 to 93. The NASDAQ 100 saw a similar decrease from 98 to 96, while the DOW 30 increased slightly from 98 to 99.

Calculating SERIX® data

The Spectrum European Retail Investor Index (SERIX®), uses the exchange’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment:

SERIX® = (% bullish trades - % bearish trades) + 100

Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

About Spectrum Markets

Spectrum Markets is a pan-European trading venue for securities aimed at financial institutions and their retail investors. Headquartered in Frankfurt am Main, Germany, and with presence across Europe, Spectrum Markets was designed for transparency, integration and openness while enabling unparalleled access to the markets beyond traditional trading hours with 24/5 on-venue trading for the first time in Europe.

Since launch in August 2019, securities listed on Spectrum Markets have been made available for retail trading in Germany, Italy, France, Spain, Sweden, Norway, the Netherlands, Ireland and Finland.

Acting as a MiFID II regulated trading venue authorised and supervised by BaFin, Spectrum Markets uses a uniquely open architecture, allowing intermediaries and product providers to offer to retail investors a unique trading experience with increased choice, control and stability.

Being an MTF (Multilateral Trading Facility), Spectrum Markets provides access to innovative products designed to give European retail traders flexibility and control over their trades. This includes Turbo24, the world’s first 24-hour turbo warrant.

Through the pan-European ISIN, 24/5 trading services, intraday issuance and a fully proprietary venue, Spectrum Markets enables a guaranteed baseline level of liquidity over a range of products, is able to swiftly and safely match a significant number of orders, and to process messages with a low latency.

Spectrum Markets publishes SERIX® – the Spectrum European Retail Investor Index – a pan-European client sentiment that informs as to whether retail investors have speculated on a bullish or bearish view on a specific underlying. SERIX® is a measure based on trades made by retail investors across Europe which can be used to compare how sentiment has changed (in terms of directionality or strength of sentiment) over time on a monthly basis.

Spectrum Markets is a wholly owned subsidiary of IG Group (LSEG: IGG).

Further information can be found at spectrum-markets.com

Media contact

Liminal

T: +44 203 778 1103

E-Mail: vasiliki@liminalcomms.com

Disclaimer

All information contained herein is for information purpose only and addresses exclusively Members of Spectrum Markets and persons interested in becoming a Member of Spectrum Markets. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any securitised derivatives listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokerage. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.