In 2021, the finance world witnessed one of the biggest jumps ever seen. Since the second quarter of 2020, the indicators show a spectacular increase in crypto adoption all over the world. Albert Salvany, blockchain and trading expert and Strategic Consultant at Belobaba Fund gives us his analysis.

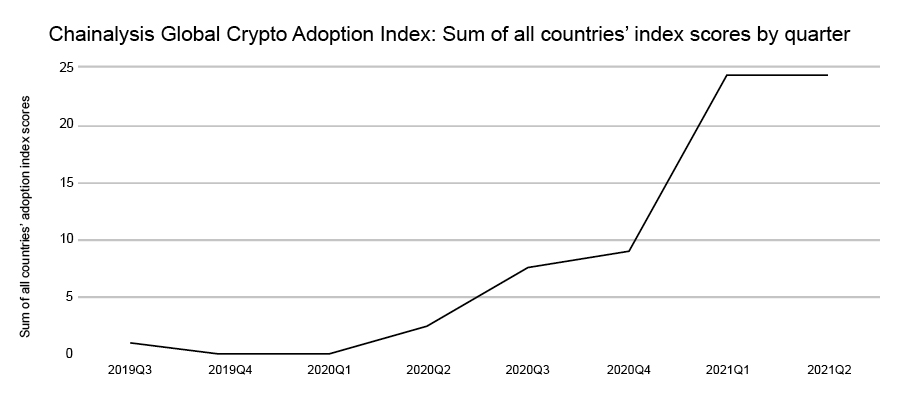

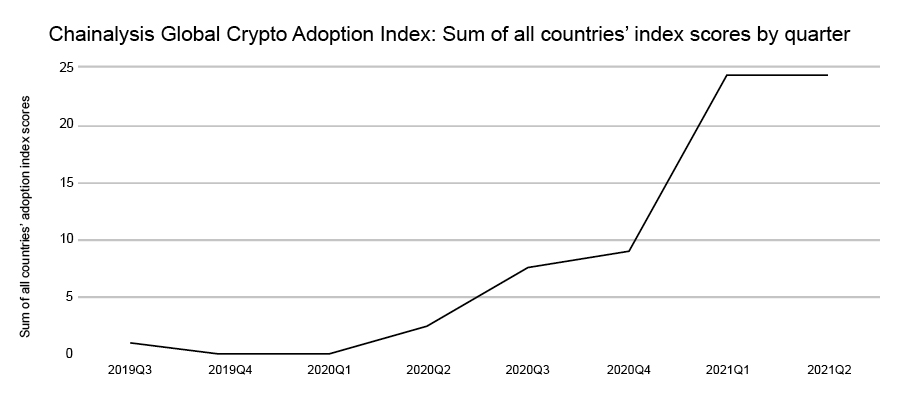

Data from the company Chainalysis shows how its cryptocurrency adoption rate experienced an exponential jump in just a few months. Undoubtedly, the pandemic situation influenced this evolution, but it is a sentiment that was already growing among many investors.

The entry of the institutional investor

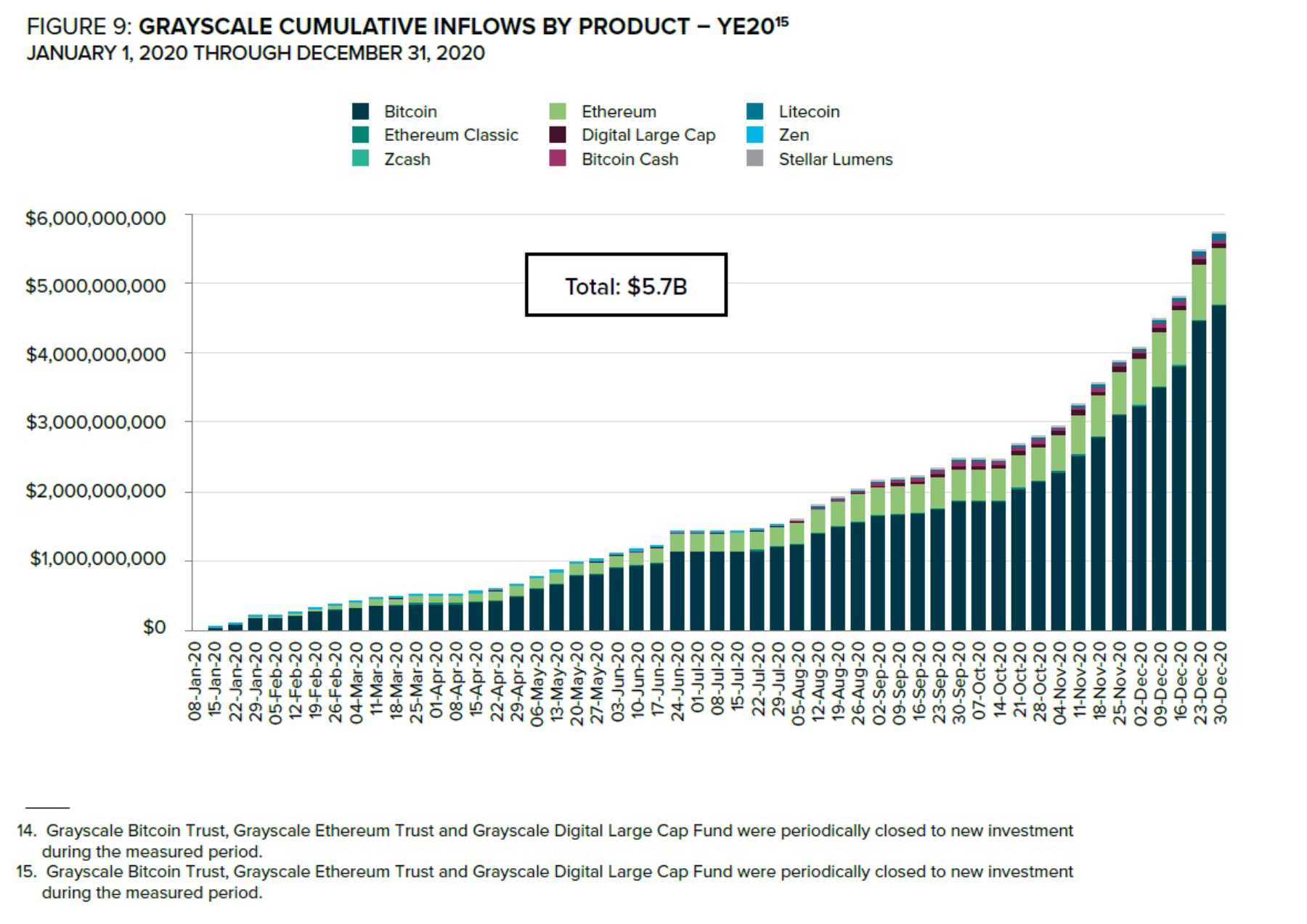

Curiosity about the crypto-asset phenomenon has been growing rapidly for a few years, followed by the acquisition of more knowledge about it. The last quarter of 2020 marked the beginning of a new era in crypto-asset investing with the rising involvement of institutional and professional investors to significant levels.

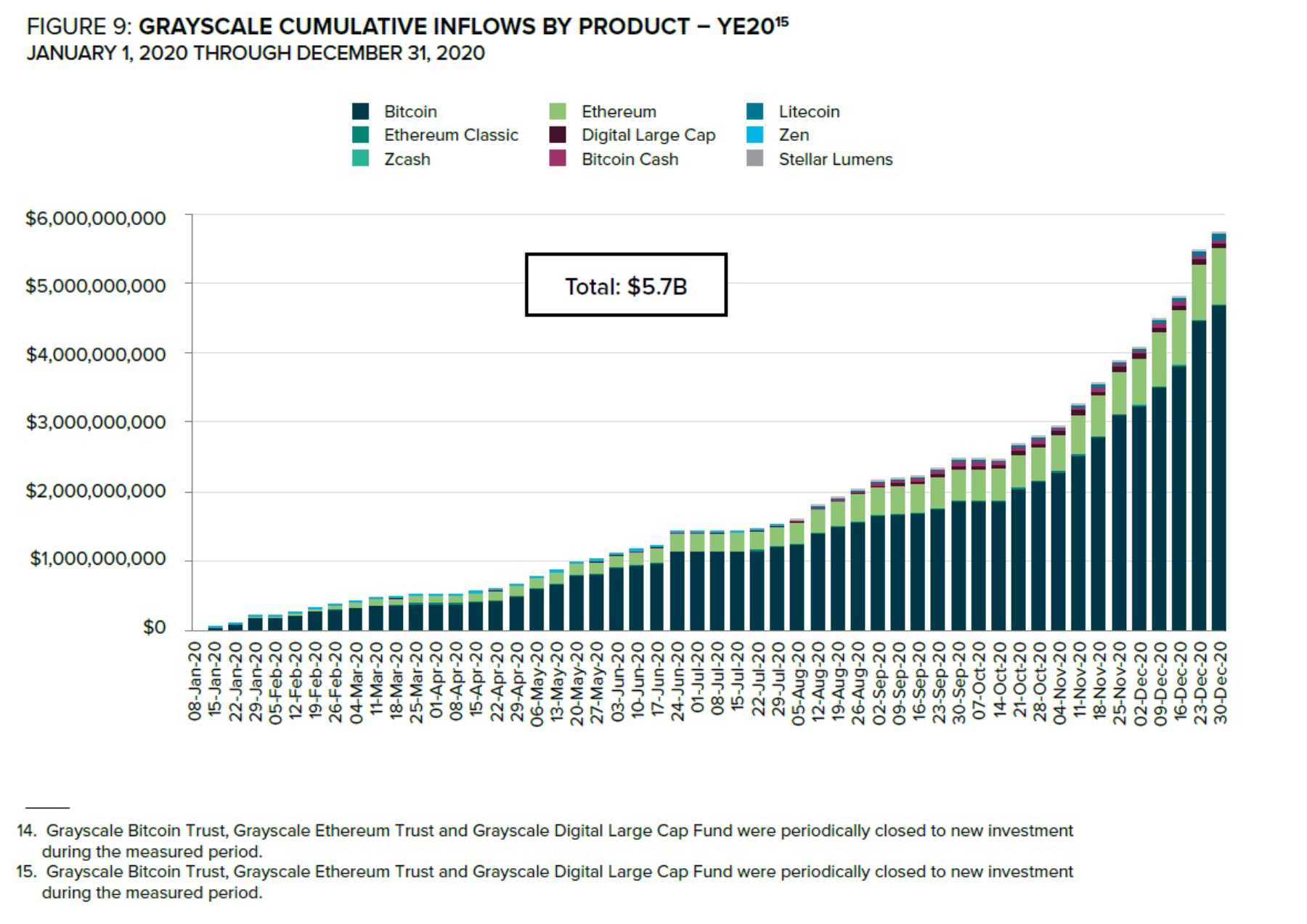

During this time, companies like Grayscale multiplied their AUM (by a factor of 5) and a series of milestones occurred that changed the market forever. The profile of the crypto-asset investor has undergone a strong evolution since then.

I believe this fact invites an in-depth analysis of the crypto-asset market and its structure. In any market, the investor profile is one of the most important factors in understanding a big concept: sentiment.

Market structure

Let’s not forget that markets are just a point of confluence of people with different interests and goals. But these people need each other. Every buyer needs one or more sellers capable of transacting at a desired price level and vice versa.

A market composed mostly of institutional investors behaves radically differently to a market composed of retail investors. And this is exactly the process that the crypto-asset market is currently undergoing. Presumably, the growth in this segment of more professional investors has been much greater, proportionally, than that of the retail segment, changing the pre-existing balance.

Low volatility

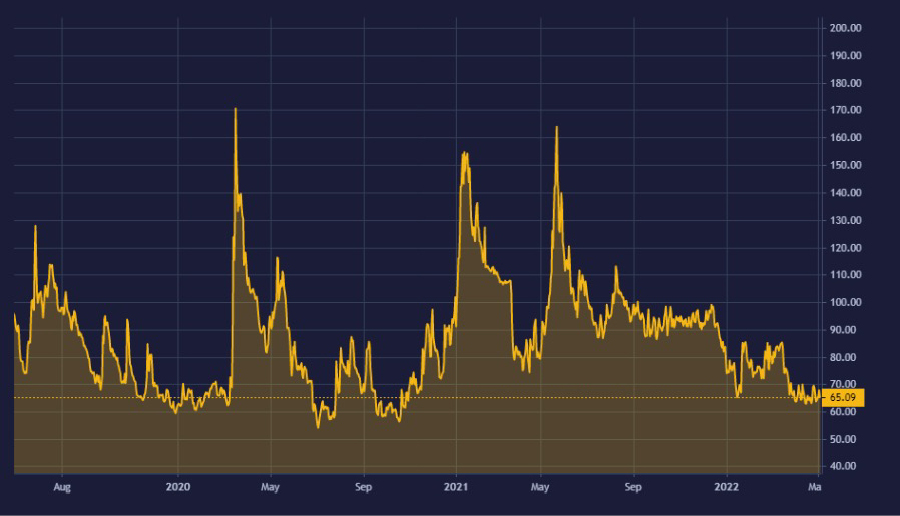

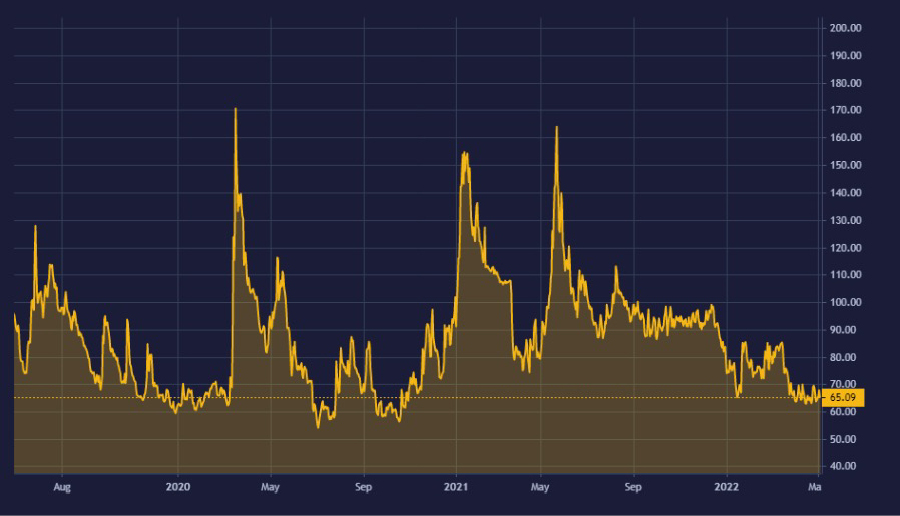

One of the consequences of this change is the decrease in volatility. Despite remaining at very high levels compared to other types of assets, volatility in crypto-assets is nothing like it was in previous periods, and this is something that investors must take into account when trading.

And this can be a new incentive to attract new investors who are otherwise reluctant to trade volatile assets. This situation may become a trap for many of them, or may end up contributing to a further flattening of the volatility curve, we do not know. What we do know is that investors of all types are increasingly entering the world of cryptoassets, in parallel with deepening their knowledge of how crypto-assets work.

The only certainty we have at the moment is the dramatic increase in crypto adoption. Which we can prove with figures and different indicators.

Equal opportunities

The digitisation processes and the creation of distributed environments encourage a ‘democratisation’ of these investment tools, always linked to the necessary training to understand these instruments and financial vehicles. We are undoubtedly facing a historic opportunity, one of those that only happens every few generations and is caused by an enormous technological disruption: the opportunity to access any market for investors of any condition and economic capacity.

The size of assets is no longer an obstacle to accessing the most sophisticated financial products, from a full-fledged hostile takeover bid to private banking. This is the essence of what we know as Decentralised Finance.

A new kind of finance

The digital transformation and adoption processes that we have seen in other sectors such as publishing or music have reached the financial sector through the so-called Internet 3.0 or Internet of Value: an economy based on revolutionary support such as free software. This leads us to the top of a process of cooperation, to the detriment of competition processes. This is the basis of blockchain projects, and decentralised financial projects are built on this technology.

The title of this article refers to the possibility for exponential growth in users. This growth will also be generated by an extension of these technologies and an increase in the supply of these protocols or applications in all areas, which will generate more supply and higher quality that will attract these new users. A substantial improvement in the user experience will also be decisive in contributing to this increase in adoption, which could lead to massive regulation.

The regulatory landscape

This is going to be another key that can make a major contribution to the necessary mass adoption of crypto-asset based tools.

The creation of more regulatory certainty will influence the development of more standardised and more easily understandable products for a wider swath of the population. This is where the current players in the financial sector can play a decisive role and, let’s not deceive ourselves, they are already preparing for it.

The role of stablecoins

In light of the extreme volatility that we can find in this market, we can find interesting alternatives in stablecoin trading, which today already offer significant advantages over trading with fiat products.

Stablecoins, as less speculative assets, can be more accepted and used in multiple cases by many users, but they need clear and transparent regulation to be generally accepted.

At this point, it is very important not to confuse two proposals that for the newcomer can be mixed-up: stablecoin and CBDCs. CBDCs, or central bank currencies, represent the continuity of the current financial model with the issuance of currency backed in a fiduciary manner by a state. In other words, the same state that issues fiat currency will issue the CBDC, only this time in a digital environment and with the possibility of greater control, but without any change in the model.

On the other hand, the concept of stable currency is associated with what we understand by liquidity. The cryptoasset system has to provide a proposal so that those who transact within it have a solvent option with guarantees of disinvestment without leaving the ecosystem. That is, without the risk of price movements in the market and the possibility of suffering depreciation in the value of our assets.

This is a vital component of any financial system. And this is the main reason why stablecoins are going to be the new focus of attention in the crypto world, especially in regulatory matters. The state that most effectively regulates stablecoins will have won an important trump card to become a pole of attraction for investment in this new economy, and the race has already begun.

Goals achieved and future challenges

As we have seen, some goals have been achieved that have signified important milestones along the way, but there is still a lot of work to be done. Many of the issues we have mentioned are yet to be developed and are still a real unknown. But even so, mass adoption is no theory: it is certain to happen for the simple reason that trading digital assets offers advantages over current trading. For instance, they are a much more efficient means of transmitting value, both in terms of processing speed and cost.

Surely the most important challenge for the mass adoption of crypto is how to establish a ‘friendly’ relationship with the traditional system. There are two possible scenarios. On one hand, dodging conflict with the status quo would be the easiest and simplest transition solution. Letting the evidence show that this new economy is more competitive than the current model is a long-term strategy, but one that ensures a smooth and seamless transition. This is the more complicated strategy because it requires long-term vision.

On the other hand, we could also enter a scenario of separation in which we see the crypto economy developing in parallel, with almost no contact with the fiat economy. But this option has many drawbacks, starting with the regulatory issue.

Finally, we cannot forget the context of radical change that our civilization is undergoing. Change in our ways of moving (climate crisis), change in our commercial relations (end of globalization and geopolitical crisis).

In this context, it is easier to add a new chip to the board that is a change in our way of transmitting value, with more efficiency, both from the point of view of costs and speed, very much in line with the times we live in. In the latter scenario, the adaptation period will necessarily be much shorter, so we would do well to be prepared.

Get in touch today to discuss how the seamless market access that our venue provides, can help to grow your retail client business.