A Classic Win-Win Situation

At the end of last month, we announced our new membership with Spectrum Markets. In this month’s issue of Spectrum Spotlight, I would like to share some background to this announcement from Intermonte’s perspective.

New ways for FinTech organisations to interact with their customers are catalysing change in the industry. For an expert perspective on this change, we spoke with Marco Mione, FinTech Team Manager at Deloitte Consulting and Vice President at the Italian Association of Technical Analysis (SIAT), where he also teaches the Masters programme in Financial Market Technical Analysis. His years of experience, combined with his work with the next generation of traders; make him the ideal person to ask for opinions on the past, present and future of FinTech.

You have many years of experience working with FinTech at Deloitte, how has the world of FinTech changed and evolved during this time?

FinTech has a long history, starting from the moment that someone first thought of applying the possibilities offered by technology to the financial markets. We could even think of the first Diner's Club credit cards in the United States in the 1950s as the genesis of FinTech; for the first time, a simple 'piece of paper' allowed people to shop without having cash on hand.

Since then, FinTech has made giant strides. But without a doubt, 2021 has been a transformative year. It was a year in which FinTech ventures represented around 21% of all venture capital investment, reaching a record $132 billion; an almost 100% increase compared to 2020.

The volumes are not the only remarkable change we have experienced. In the second decade of the 2000s we have entered the so-called "digital age". The maturation of technologies such as artificial intelligence and the cloud allows the power of data to be harnessed to the full, enabling start-ups and other businesses to manage an impressive amount of information, which makes all the difference in terms of customer insights and the ability to offer personalised products.

Lastly, we can’t avoid acknowledging the role of cryptos. In 2008, Satoshi Nakamoto offered us a disruptive ecosystem, capable of creating scarcity in the digital world. Today, digital assets are considered to be the future by executives of the world's leading financial institutions, with 80% believing that cryptos will play a very important role in the industry in the next two years, while 76% believe that not investing in blockchain means losing a competitive advantage.

Applications of this technology are rapidly evolving in different directions, but they all have in common the drive towards a new version of the web. Blockchain, along with other technologies, could be at the heart of the 'next web revolution' - otherwise known as web3 - a decentralised web that for some will be the natural evolution of the current centralised web dominated by big tech.

Do you believe there is a future for cryptocurrencies?

The last year and a half saw a maturation in the world of cryptocurrencies. Listed companies, such as Tesla or Microstrategy, have made it public that they have invested large amounts of capital in cryptocurrencies, sparking a lot of interest and debate in the media. The arrival of Coinbase on the stock market then triggered a new phase of legitimisation of the cryptocurrency sector among traditional investors, also supported by the widespread trend of banks and financial institutions offering trading and custody services for digital assets.

Visa and PayPal, which entered the crypto world in late 2020, moved on with and expanded their plans during 2021. Finally, the main players in the cryptocurrency realm proved they have been working towards reaching mass adoption. This is demonstrated by strong commitments from players such as FTX, Binance or Crypto.com, which have signed large sports sponsorship contracts in an effort to speed up adoption by retail customers. Meanwhile, institutions and some large companies turned their attention to stablecoins and CBDCs.

The fact that cryptocurrencies are here to stay is proven by regulators’ moves on the matter. The US regulator has shown openness towards stablecoins, but it has not yet taken a definite position on the CBDC issue. In Europe, on the other hand, the Digital Euro is in its way, with tests continuing leading to the launch date set in 2026. Five years might be too long if we consider the speed with which other countries are moving: among them China, which is rapidly advancing the development of the Digital Yuan, which it aims to make available internationally.

Do you foresee any major obstacle that need to be overcome?

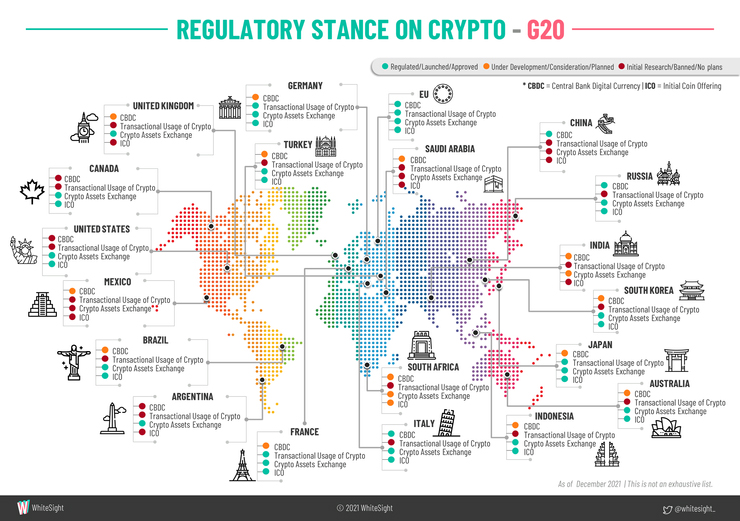

In my opinion, the main obstacle slowing the mainstream adoption of cryptocurrencies is a lack of knowledge and understanding of the subject. And let’s not forget that regulation can work as a catalyst or as a restraint to innovation. Worldwide we can see a proliferation of regulatory initiatives aimed at creating an orderly environment for the development of cryptocurrency-based digital asset markets.

It is often thought that cryptocurrencies operate outside the reach of national regulations, yet their prices and transaction volumes are strongly influenced by news about regulatory interventions. News about general bans on cryptocurrencies have the biggest negative effect on prices, followed by news about restrictions on interoperability between cryptocurrencies and regulated markets. Conversely, news about the adoption of a regulatory framework focused on cryptocurrencies coincides with strong rises in those markets.

I believe this is partly due to the fact that people often rely on regulated institutions to convert normal currencies into cryptocurrencies (and back again). We look forward to the development of the Markets in Crypto-Assets (MiCA) Regulation.

In your various roles, you’re close to experienced traders as well as to newcomers who are starting to develop their own trading and investment strategies. So, we could say you have the pulse of the next generation of traders. Have you seen major changes in the trader’s profile – is there a Trader 3.0 on the way?

This is a question that the Board (of SIAT) and I often discuss. We all agree that we are seeing a strong increase in interest towards cryptos, primarily among millennials. When looking at strategies and trading models, we see proliferation in the use of systems that are increasingly automated and less discretionary. Lastly, the trading activity is becoming less frantic, with longer reference timeframes.

With SIAT Trading Day Campus, SIAT has created an event that has become the place to be. What’s the reason for its success?

Over the years I have come to understand curiosity and eagerness to continue learning are key to success in our job, and that on-field experiences are the best opportunities to have a measure of this world.

SIAT created an event designed to put creativity first. This means, year after year, finding an original filter to look through when analysing the big trends and topics we see in the day-to-day. That’s the essential ingredient in the SIAT Trading Campus recipe: an element of surprise that leaves a unique memory, and carefully designed content that is easy to understand, accessible and truly inclusive.

Besides the content of the event itself, there are people to connect with, either by finding a common topic or by sharing a glass of fine wine. This is also part of who I am: I love to listen, learn and discuss. I’m amazed at how we managed to transform a very technical subject in an important, informal and comprehensive gathering.

Every year you bring about a new initiative aimed at finding out more about how retail investors behave and make decisions in trading and investing scenarios. What was done in 2021?

Disciplines such as neuroscience, economics and psychology have been trying for years to explain how the interaction between an individual's internal processes and external conditions (such as stress and diet) affect decision-making.

Last year's research added a third factor, the gut microbiota. Some lines of research suggest that the gastro-enteric nervous system is our first brain, the oldest and most primitive in evolutionary terms. The intestine would appear to be more intellectual than the heart and may have a higher 'emotional' capacity.

So, we wondered how gut flora interacts with the central nervous system and influences investors' attitude to risk and financial-economic choices. Thanks to a collaboration with the APC Microbiome Institute in Cork and the Italian Institute of Technology in Genoa, the research combined experimental sessions with the analysis of biological samples from participants, about a hundred professionals equally divided between traders and asset managers.

What about this year?

This year's event will take place on May 27th at the exclusive Palazzina del Peso at the Ippodromo del Galoppo in Milan. In the tradition of the event, there will be speeches on discretionary trading, systematic trading, analysis of specific assets, quant models and we have also planned in-depth sessions on cryptocurrencies.

We will also present the preliminary results of this year's scientific research, conducted with the University of Brescia. The aim of the study is to draw up a sketch of the modern online trader, gathering information on their habits, perceptions, opinions and investment styles, as well as on their psychology and the fabric of their social relationships.

Last but not least, personally my favourite session, will be The Game of Minds. This is an event within an event, an economic and financial culture challenge dedicated to the academic world and open to students from the main Italian universities. Representatives from the various universities will test their knowledge of economics and finance in a race to the last answer. This is a challenge that we are launching first and foremost at ourselves, to help us tell young people about this world and the many professions that make it up, from analysts to traders, from consultants to experts from the academic world and beyond. And above all, to do this in a surprising, fresh and exciting format.