Insight by Nicolas Nordin, ETP’s Head of Business Development

ETP Data Systems has developed a central hub for collecting, standardising and distributing data within the structured retail investment products industry. ETP’s Head of Business Development, Nicolas Nordin, gives Spectrum Spotlight an insight into their unique platform.

The European structured investment products industry has encountered many drastic evolutions over the years; the complexification of products, the emergence of a multipolar trading environment with new trading venues and the introduction of a broader regulatory context (MIFID2) aiming for better transparency and protection for the retail investor.

Meanwhile, the appetite for those products, in a zero and later negative interest rate policy environment has kept increasing. According to the latest EUSIPA market report (EUSIPA Q1 2021 report), in the first quarter of 2021, the turnover on structured investment and leverage products in Europe (across reporting markets) exceeded €40 billion, with nearly 1.4 million new issuances (for comparison 0.55 million were issued in Q1 2012) and almost 1.8 million outstanding ‘live’ products.

Each market participant has needed to adapt: the multiplication of trading venues made it almost impossible to figure what was traded. For distributors, with each issuer using its own syntax for pay-offs and underlyings, standardising the various flows requires a tremendous effort, as does collecting all regulatory data for these myriad products.

Anticipating those evolutions as early as 2010, ETP Data Systems was founded as an entrepreneurial initiative from capital markets and IT professionals. In its mission to expand visibility and transparency for the benefit of all market participants, ETP laid the foundations to overcome those pitfalls. With full support from AFPDB (the French arm of EUSIPA), ETP developed a comprehensive repository with all the necessary static and dynamic standardised data (except Real Time book order) enabling distributors to perform their activity with one single source that would evolve according to the new requirements of the structured products industry.

ETP Data Systems has since become a central hub for collecting, standardising and distributing data within the structured retail investment products industry, supported by its clients whose changing needs drove its development. The most recent illustration of this is the recent partnership with the issuer Raydius (with their securitised derivatives being listed on Spectrum) bringing new challenges to this industry through a brand new approach for retail investors with products available for trading 24/5.

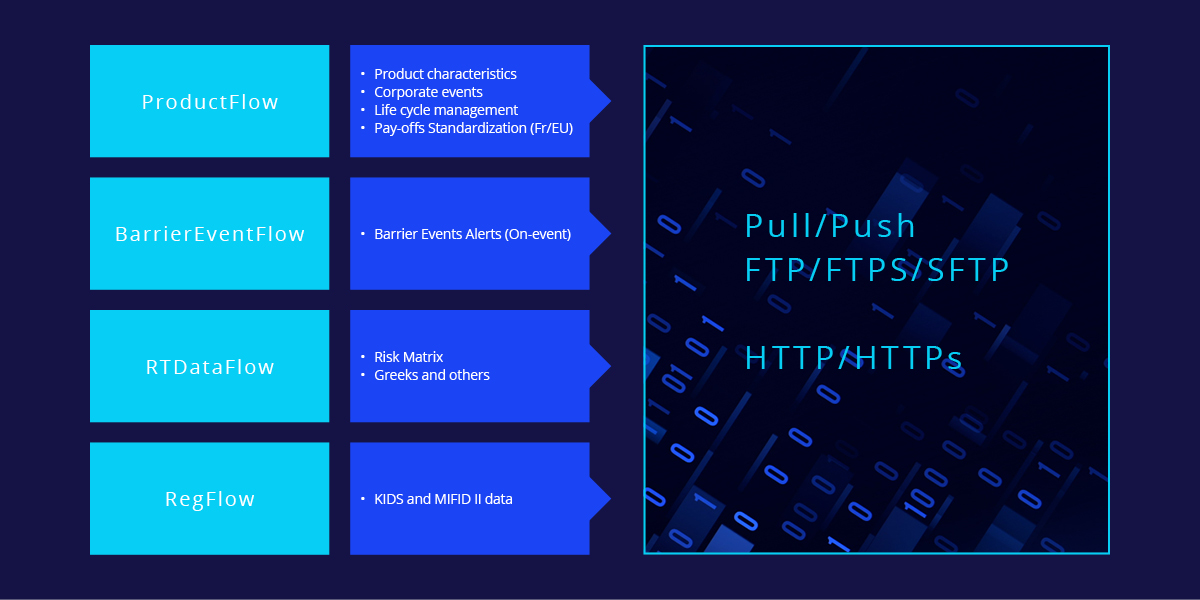

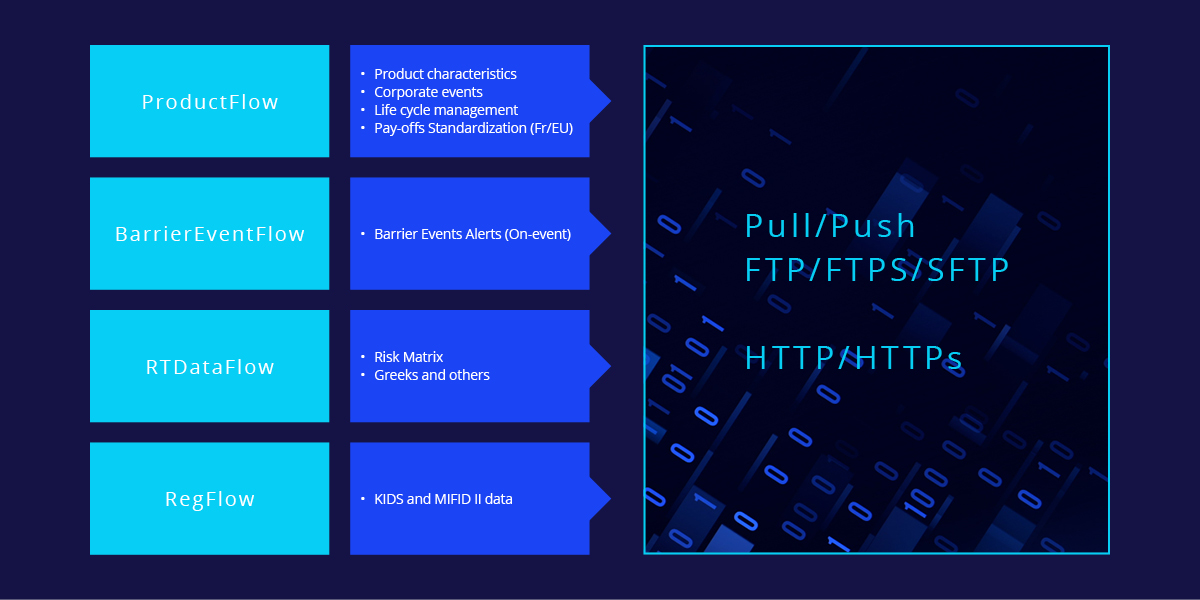

With direct bilateral communication protocols in place with each issuer and a thorough data quality management process in place, ETP enhances the reliability of collected and disseminated data. The standardisation step for payoffs (following EUSIPA codification) and products’ underlying contributes to offering an easy-to-use repository.

This direct link with the issuer enables ETP to receive intraday information such as knock out events for Turbos and maintain an up-to-date repository at any time, protecting distributors from retail client complaints for misleading information and enabling them to focus on the development of their activity.

ETP Data Systems maintains a deep knowledge of the evolution of the structured products segment through regular participation in workshops and strong relationships with many market participants (issuers, distributors, exchanges and regulators). This enables ETP to fully support its clients through constant enrichment of the repository. The flexibility of the platform, independent and agnostic towards listing places and trading venues, allows us to address arising issues coming from changes in regulation and product innovation (US871m, KID for PRIIPS, cost & charges reporting, etc.).

Beyond proposing its repository, ETP has developed various solutions linked to the securitised derivatives segment activity for information, marketing and regulatory purposes:

- With connected issuers sending the detail of their trades on all trading venues, ETP is in a unique position to get an overview of what actually takes place on the retail derivatives segment; this serves all market participants in understanding better where the activity concentrates most (underlyings, payoff types etc.), how volumes evolve over time, the off-Exchange part of trades, etc.

- With its dual expertise in both IT and financial markets, ETP has developed marketing tools for distributors willing to help their retail clients navigate the thousands of issued products: search engines, multi-issuer warrants and turbo maps, all updated intra-day with risk indicators.

- With regulatory constraints increasing, ETP Data Systems ensures that key data are properly disseminated towards their clients. Unlike other types of financial products, structured products have fluctuating characteristics, especially cost & charges data. As an illustration, ETP data systems further developed a solution that consolidates the structured products related costs incurred within a portfolio, helping distributors to comply with their regulatory obligations.

ETP Data Systems’ state of the art IT infrastructure, proven by client satisfaction and loyalty, is highly scalable and ready to adapt to new market initiatives such as Spectrum turbos 24/5 trading. The strong team of IT professionals systematically proposes various options before implementing a new solution, adapting to its clients’ own setup to ease the integration process.

Through this new partnership, ETP Data Systems will reinforce its footprint in the retail derivative products industry in Europe and provide Spectrum with all the necessary support to help them fulfil their objectives.