Angelo Ciavarella, Senior Lecturer in Trading in Financial Markets at the University of Greenwich, on the shocks of the past year and survival tips for 2023.

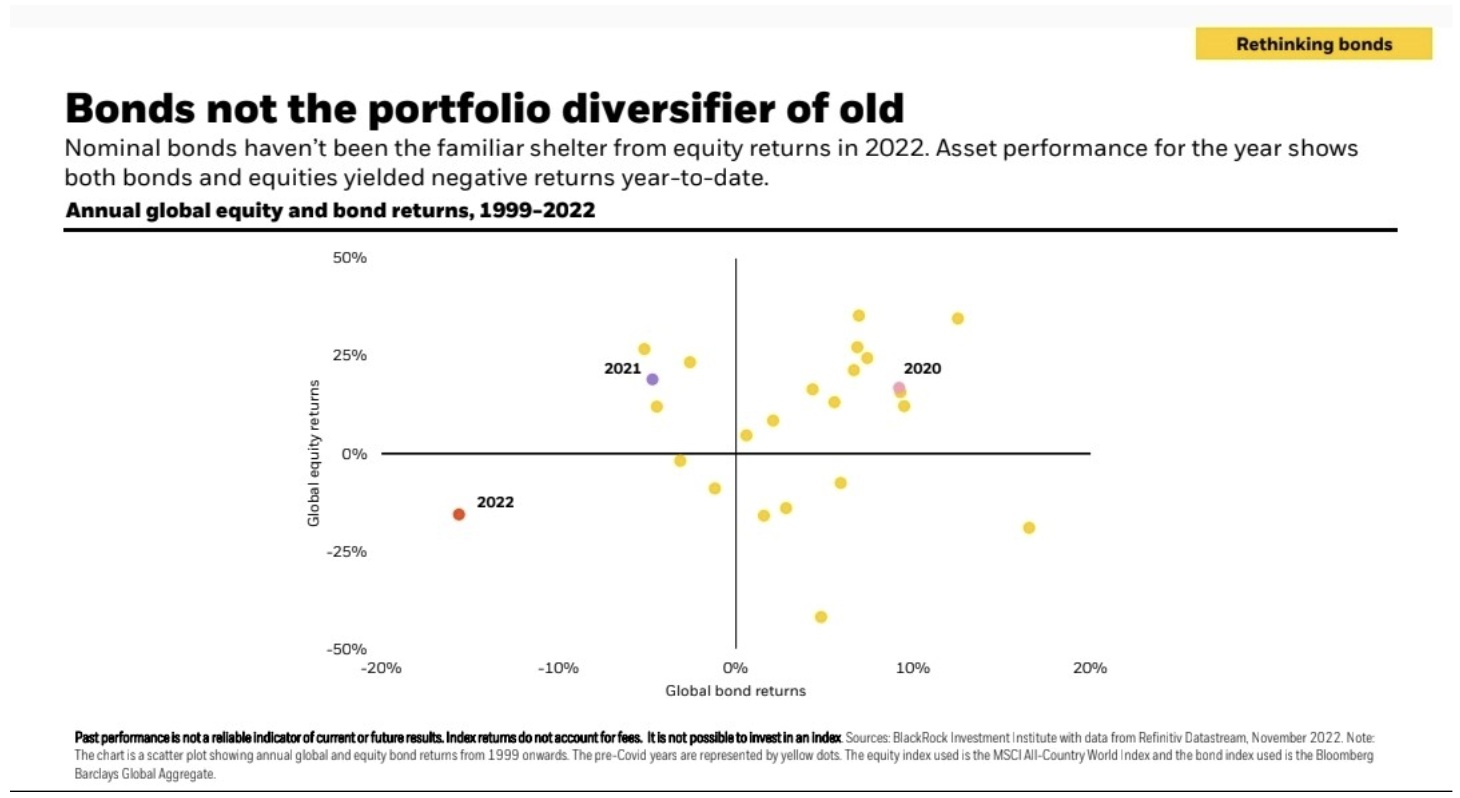

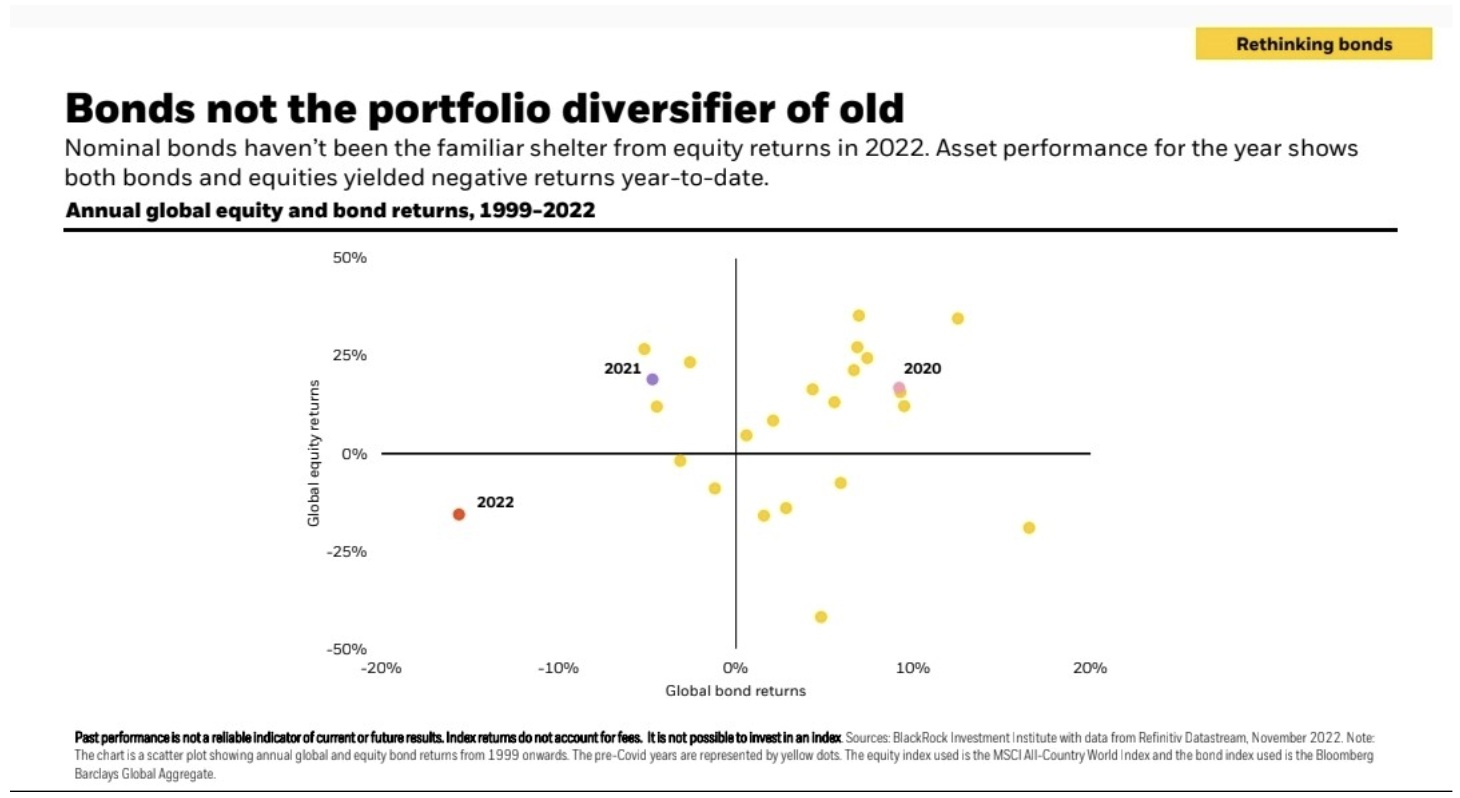

The past year will surely go down in history as one of the worst ever for the investment world. Conventional wisdom has always led us to believe that a significant decline in equity markets is usually offset by a gain in bonds, at least based on what happened in the past, particularly in 2008. Instead, in 2022 bonds crashed as well as stocks and lost their defensive function.

The year 2022 was characterised by the comeback of an economic variable that disappeared in recent decades and that was totally forgotten by even the most experienced investors: inflation.

Surging inflation has completely changed the investment playbook of the last 15 years where the active presence of central banks and cheap money inflated all asset classes. Globally, inflation has reached levels not seen in decades: in the U.S. a few months ago it surpassed 9% (the highest level since 1980), in the U.K. it went over 10% (the highest level in 30 years) and in Europe it stood at 10% (a record for eurozone countries).

There are several reasons for these spikes, but the three main ones are:

- The amount of money put into the system by both central banks and governments to fight the steep recession caused by the Covid-19 pandemic

- Problems related to supply chains

- The war in Ukraine, which sent the prices of commodities, especially oil & gas, soaring

Incidentally, let us recall that the main, or rather essential, purpose of central banks is "to ensure price stability," which is commonly interpreted as a level of inflation around 2%.

As a result, the U.S. Federal Reserve (followed by the European and British central banks) found itself in the uncomfortable position of having to fight inflation that it first deemed "transitory," and then had to chase up by raising rates more than 4% in a year (the fastest hike in 40 years).

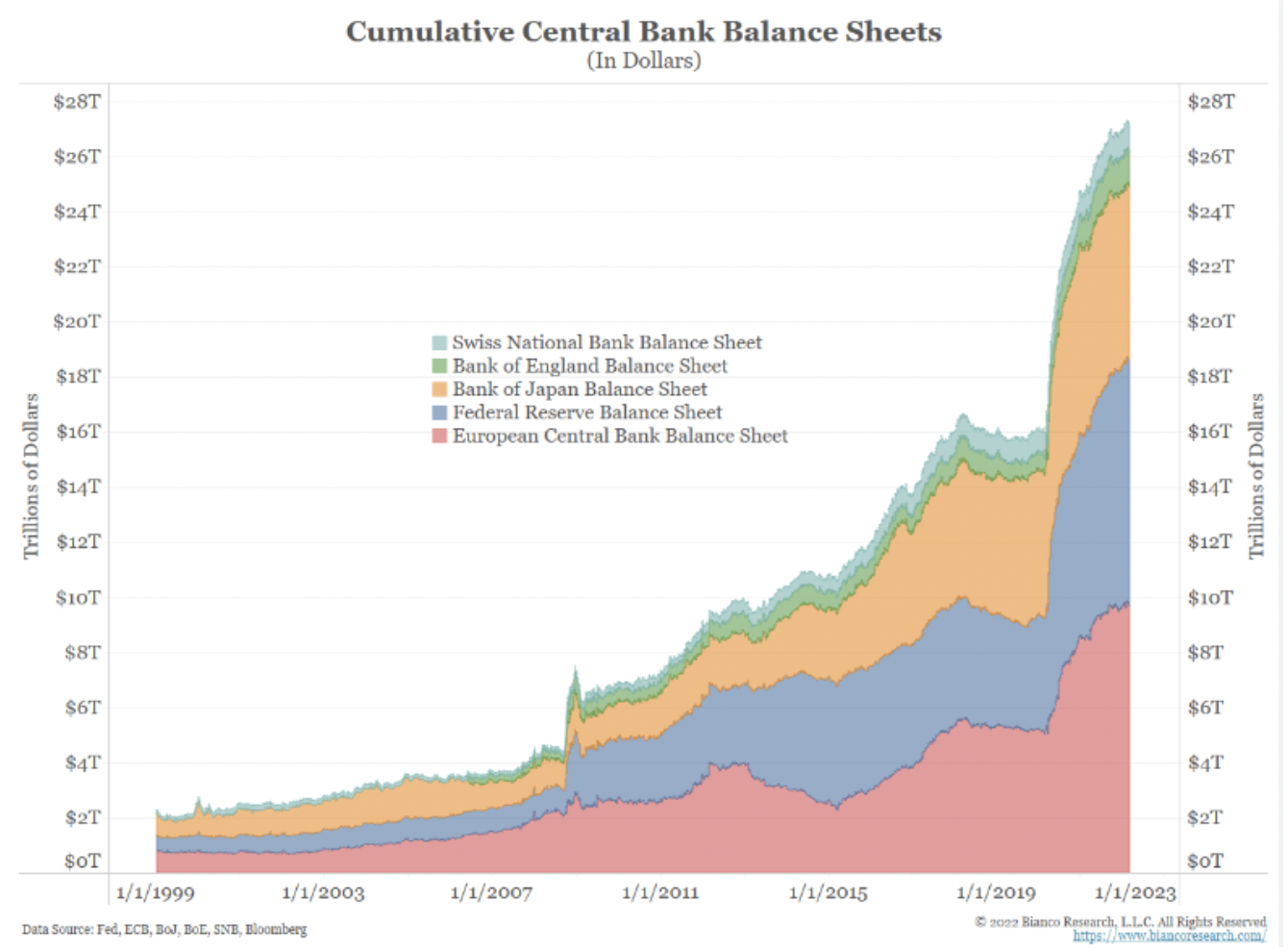

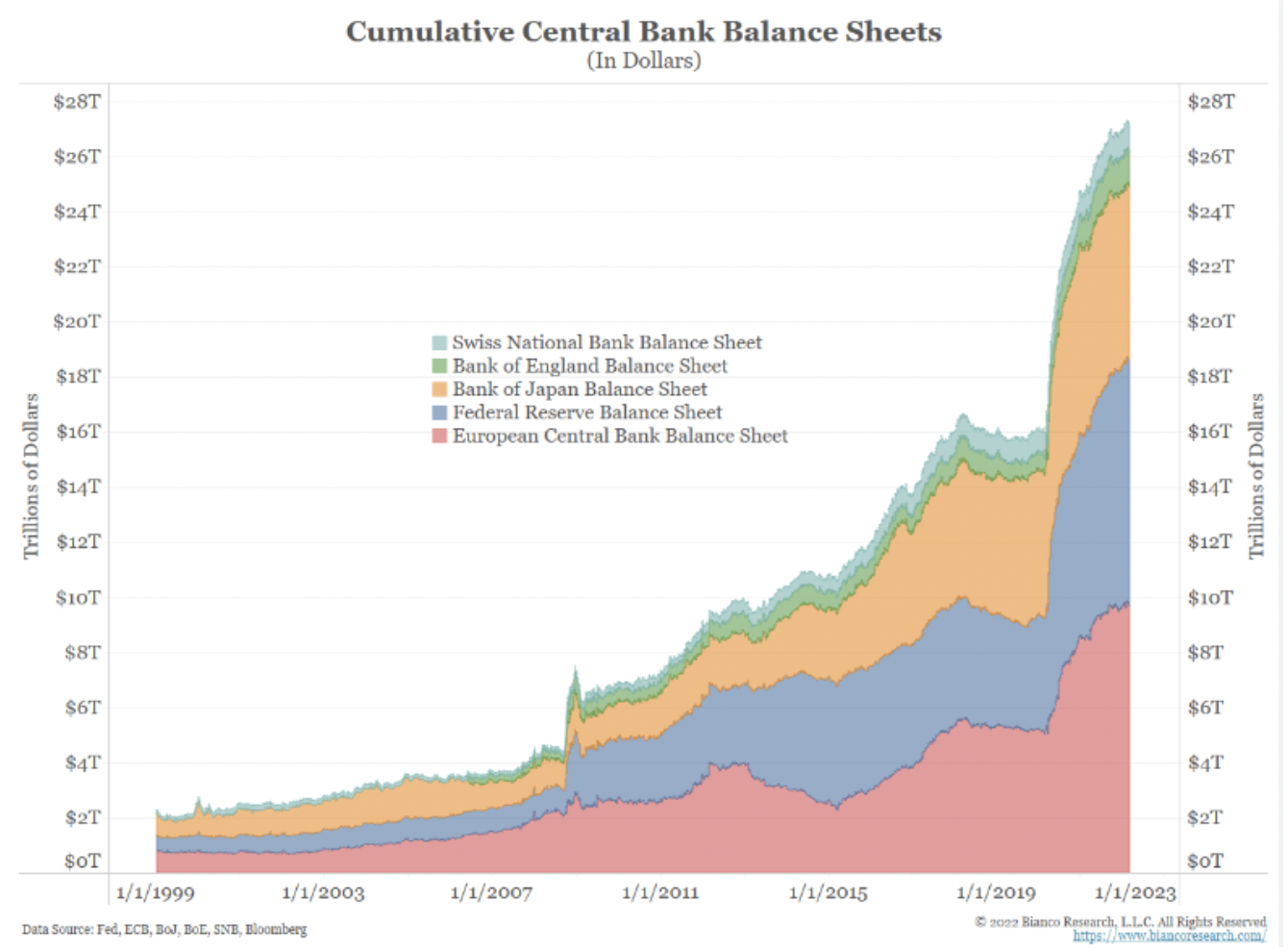

The experience of "quantitative easing," or the purchase of bonds and other assets by central banks, which started cautiously after 2008, accelerated significantly during the pandemic. The combined balance sheets of the biggest central banks skyrocketed to more than £25tn. On the one hand these “extraordinary” policies helped the world economies to come out of a deep recession, but on the other hand, they had the side effect of "inflating" all asset classes pushing valuations to decidedly unsustainable values.

The central banks' balance sheets more than doubled in less than two years with long lasting consequences.

The spike in Inflation pushed all the major central banks in 2022 to reverse the course of their policies (with the exception of the Bank of Japan): from expansionary to restrictive, resulting in a "re-pricing" of all different financial assets.

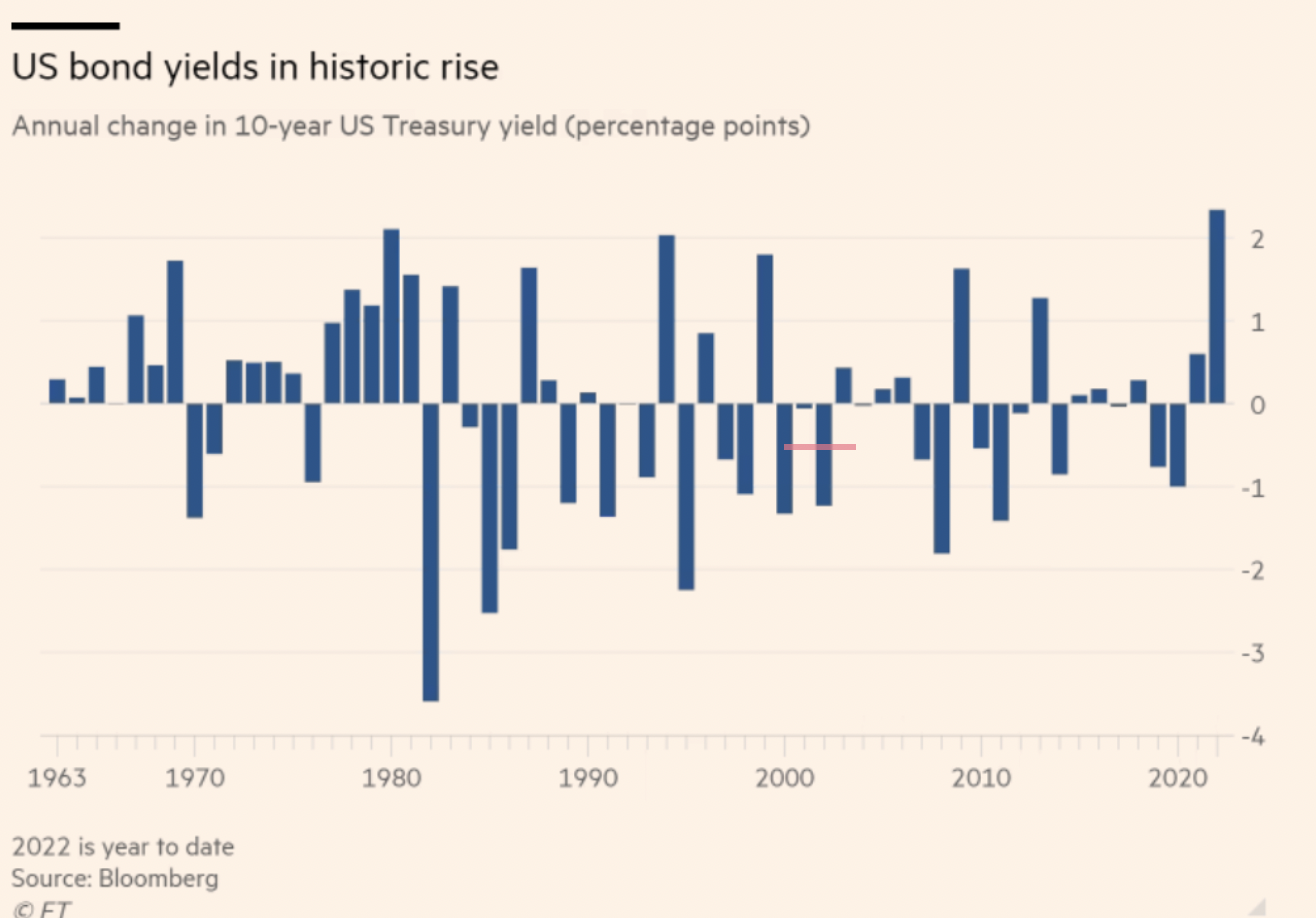

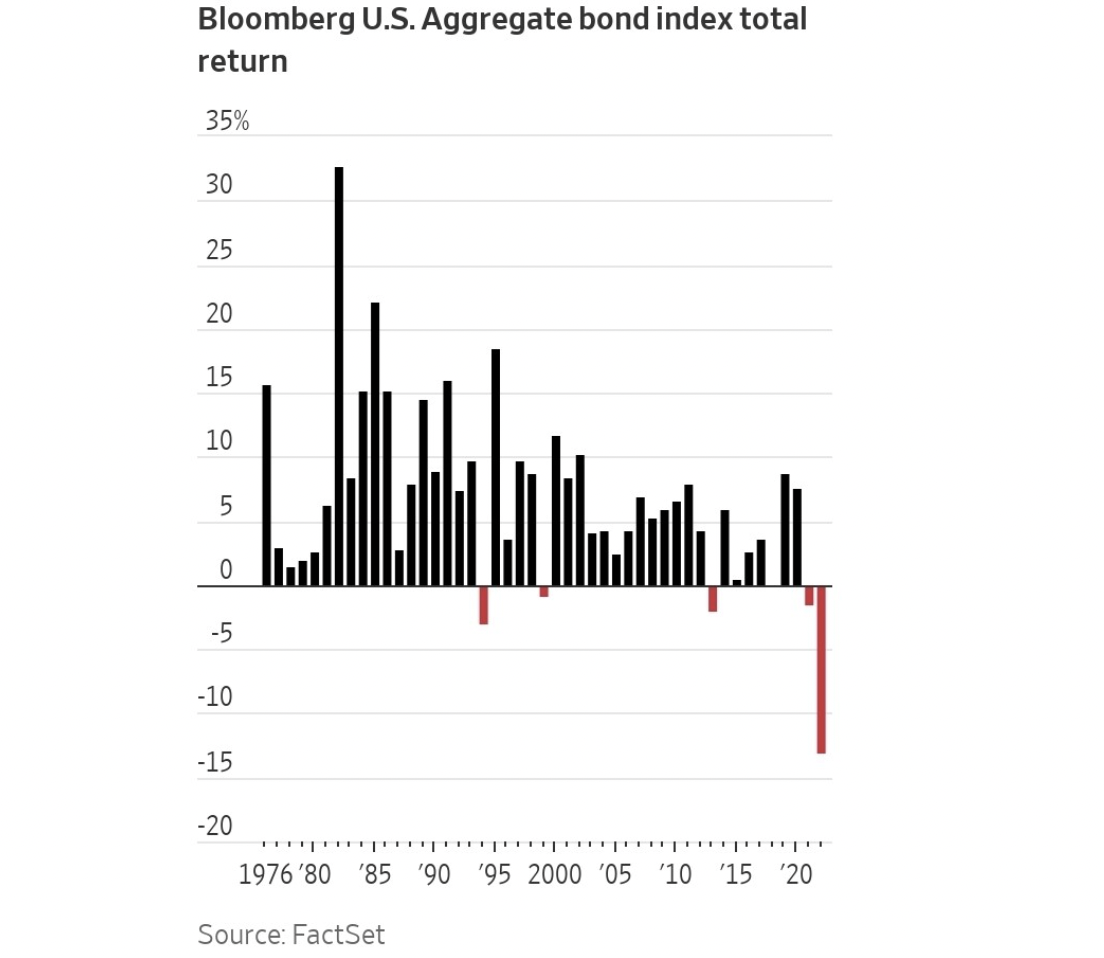

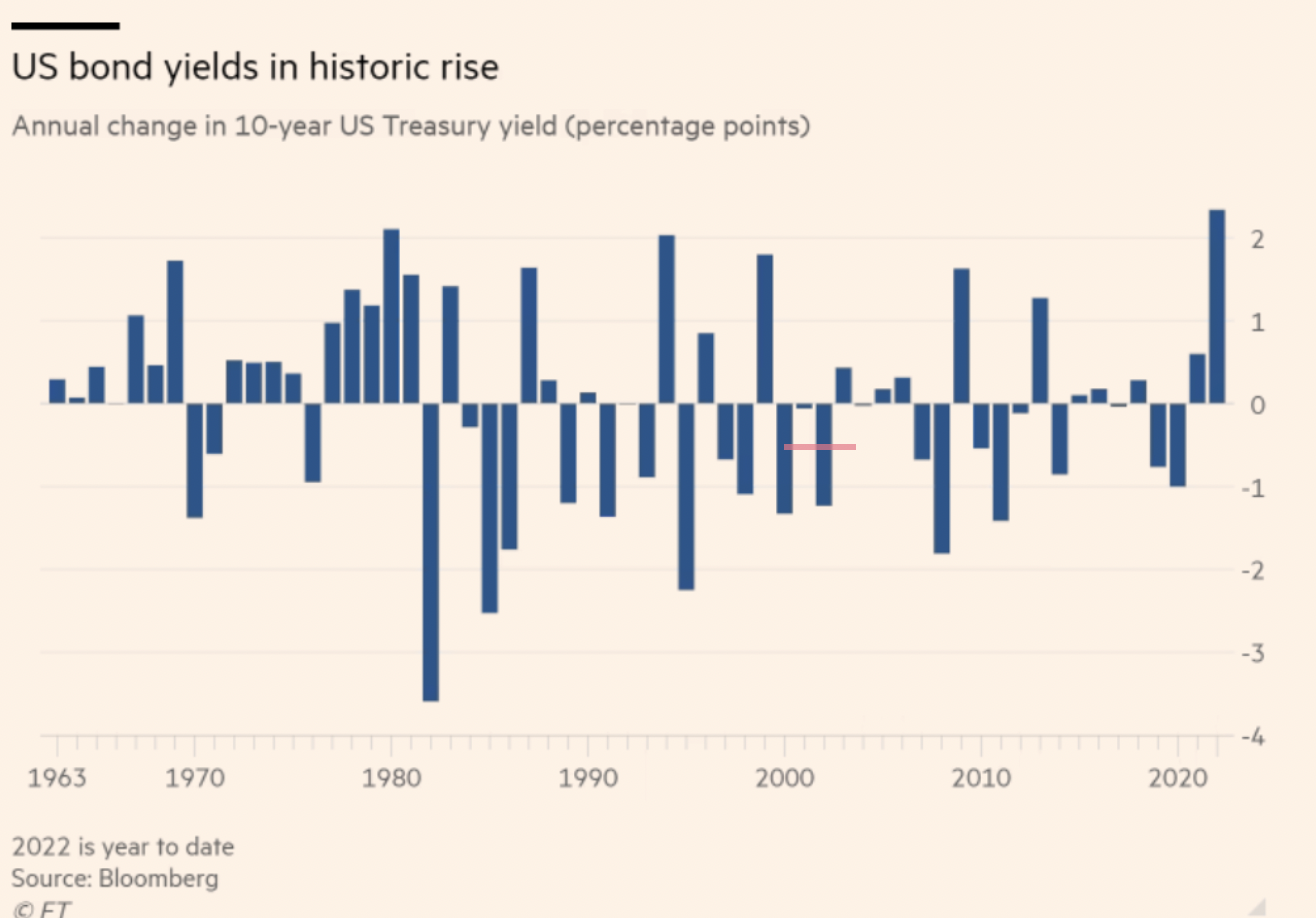

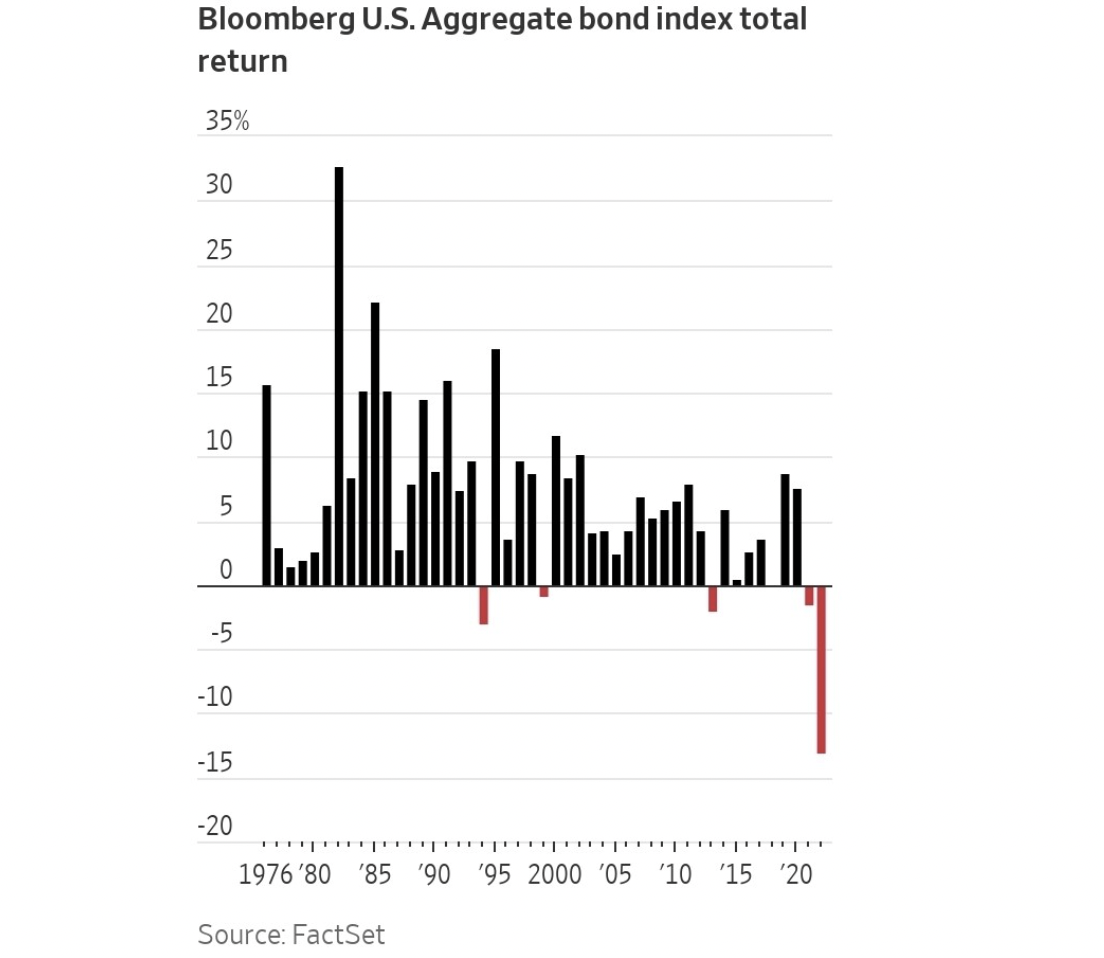

The Federal Reserve in the U.S. was the first to act, raising rates from 0% in 2021 to 4.25%/4.50% in late 2022 to try to curb inflation. The immediate consequence in the bond market (closely related to rate policies) was a jump in U.S. Treasury yields which at the end of 2021 were yielding about 1.4%, while at the close of 2022 they flew to 3.9%, putting them on an upward trajectory not witnessed since 1960.

The price of bonds collapsed (yields and bond prices are inversely correlated) leaving investors nursing losses of around 15%, making it one of the worst years ever.

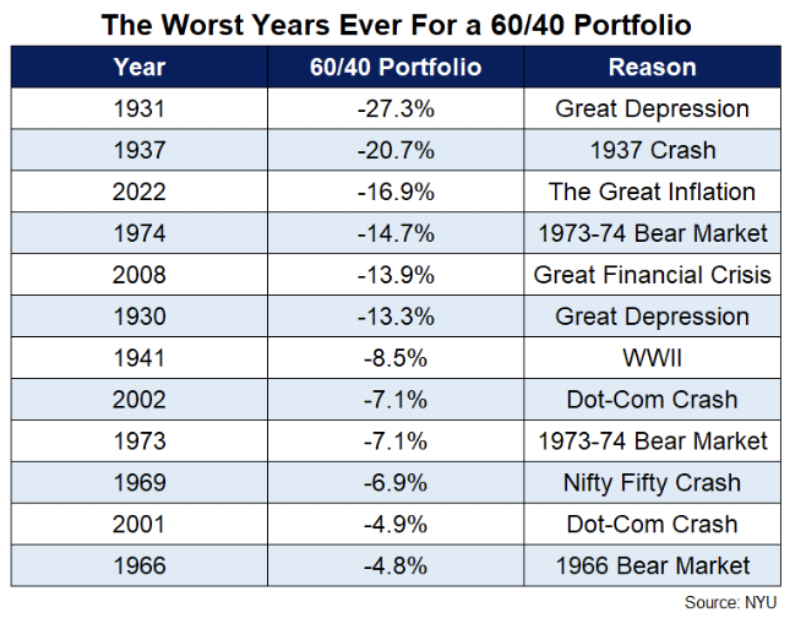

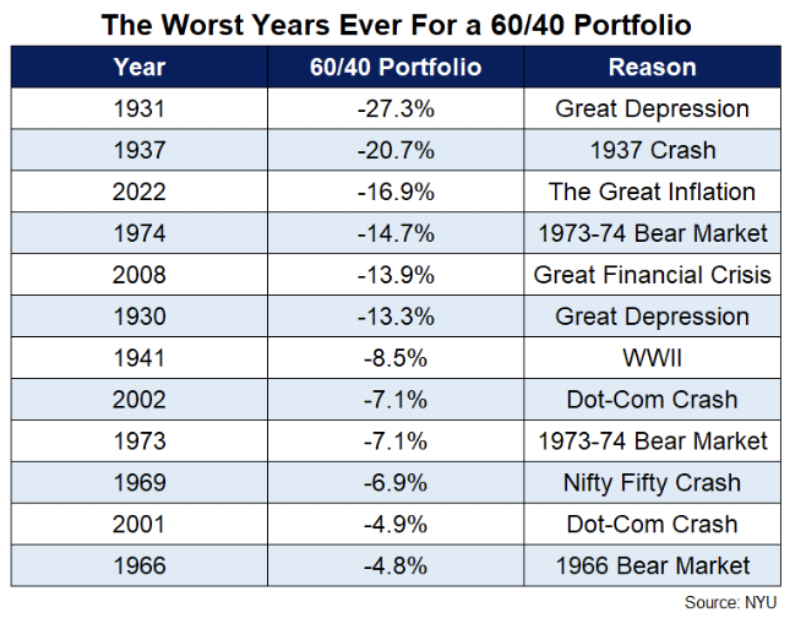

According to Renaud de Plant, Head of Pictet, a financial services multinational that manages $635bn, “2022 was the year with the greatest wealth destruction in the last 100 years." In fact, 2022 saw over $25tn wiped out, with the bond market alone losing over $10tn and the equity market losing the remaining part. From a strictly statistical point of view, last year was one of the few years since 1926 during which both equity and bonds suffered double-digit losses. And the so-called balanced portfolio with 60% invested in equity and 40% in bonds, which has performed so well for several decades, recorded its third worst performance ever, with a loss of around 17%.

The MSCI World Index, which captures large and mid-cap representation across 23 developed markets, slipped about 14%, while global bonds lost about 15% (in U.S. terms).

Wall Street recorded its worst performance in 14 years, i.e., since the Lehman Brothers bankruptcy in 2008. Specifically, the Dow Jones fell 9%, the S&P 500 lost 19% and the Nasdaq contracted as much as 33%. The blue chips got slammed, with Tesla losing nearly 70%, Meta 64%, Google 40%, while Apple and Microsoft each lost about 30%.

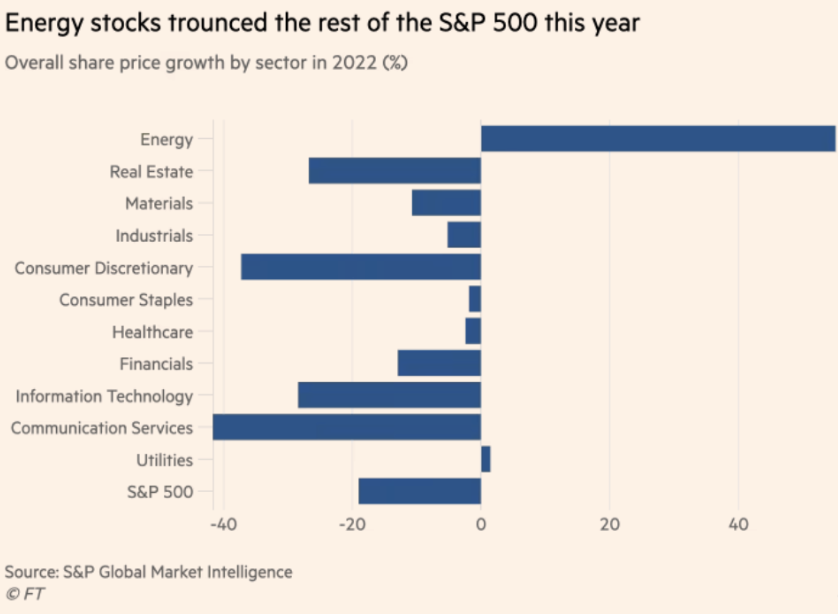

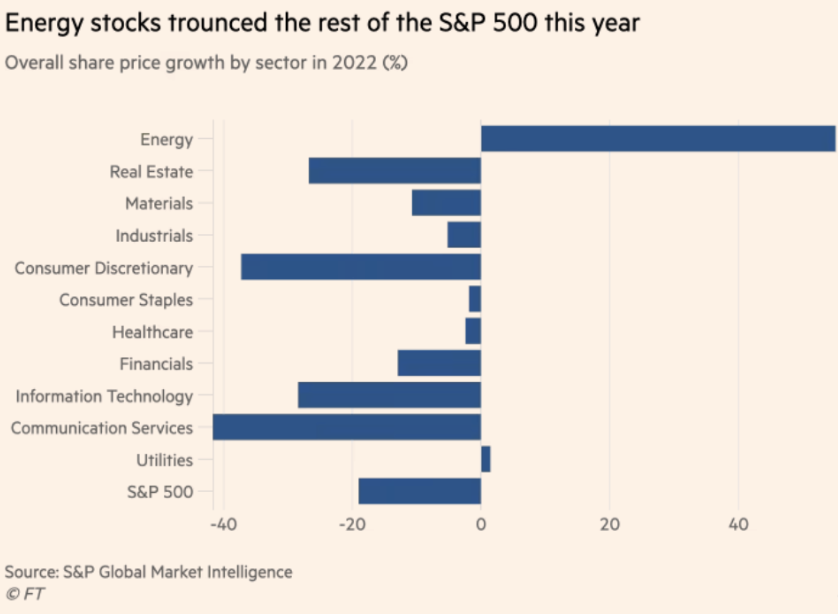

On the other side of the spectrum energy stocks soared, including Chevron which gained 40% and Occidental Petroleum that closed with more than 100% gains. Within the 11 sectors of which the S&P 500 is composed, only the energy sector closed positive, while the worst performer was consumer services.

Commodities were the only asset class that performed positively in 2022. Driven by the prices of natural gas and oil, commodities increased by 9%, as measured by the S&P GSCI.

The crypto world crashed with bitcoin posting a loss of around 70% and the industry losing over $1.7tn in capitalisation. Besides, the bankruptcy of FTX (one of the world's largest exchanges) has undermined the confidence of small investors.

The question now is: what are the prospects in 2023? History teaches us that since the post-war period Wall Street has had back-to-back negative years only 4 times. Much will depend on inflation, which is expected to decrease this year, and on the Federal Reserve's decisions. At the moment, Jay Powell, the chairman of the Federal Reserve, expects to keep rates around 4.8% by the end of 2023, while the market is betting on the Federal Reserve cutting rates to 3.8% in the second half of the year. This difference may well be of substantial importance when we consider the potential performance of the asset classes.

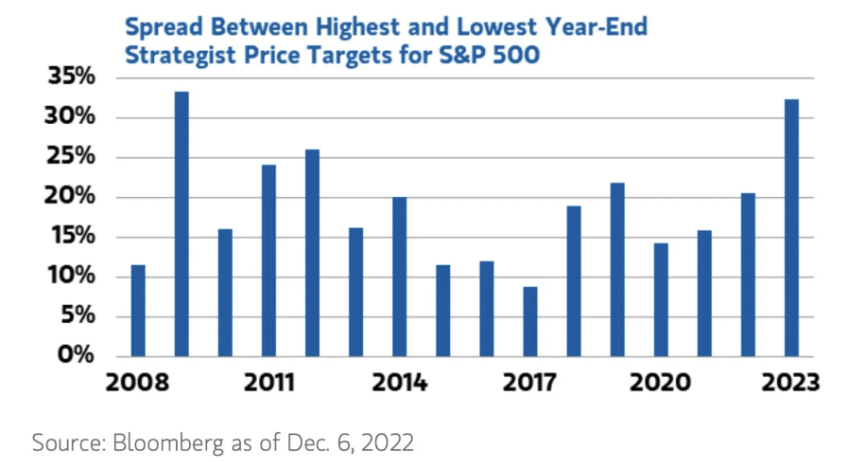

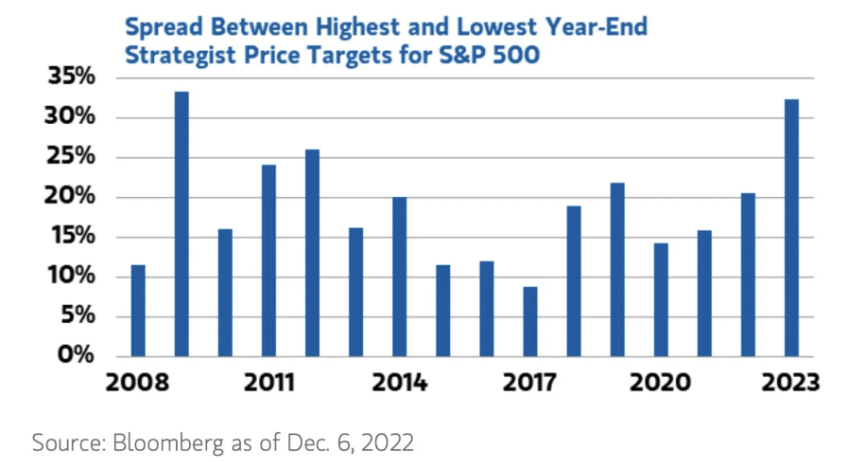

Investment banks’ forecasts are spread out as uncertainty around inflation and the war in Ukraine is still very high. Almost all the banks agree that markets will see new lows, but then there are analysts who see equity gaining as much as 15% and others that see a loss of 18%. The average consensus is for a gain for the S&P 500 of about 5%.

My personal view is to be long on bond duration and accumulate gradually on the sectors that suffered the most last year. Accumulation would need to be done only during the sell-off that inevitably will occur in the first quarter. Do not chase the price in a bear market: that would be a mistake.

Within the 11 sectors, the preference is for the financial sector, information technology and real estate. The energy sector has become too expensive whereas the blue chip stocks could deliver a surprise.

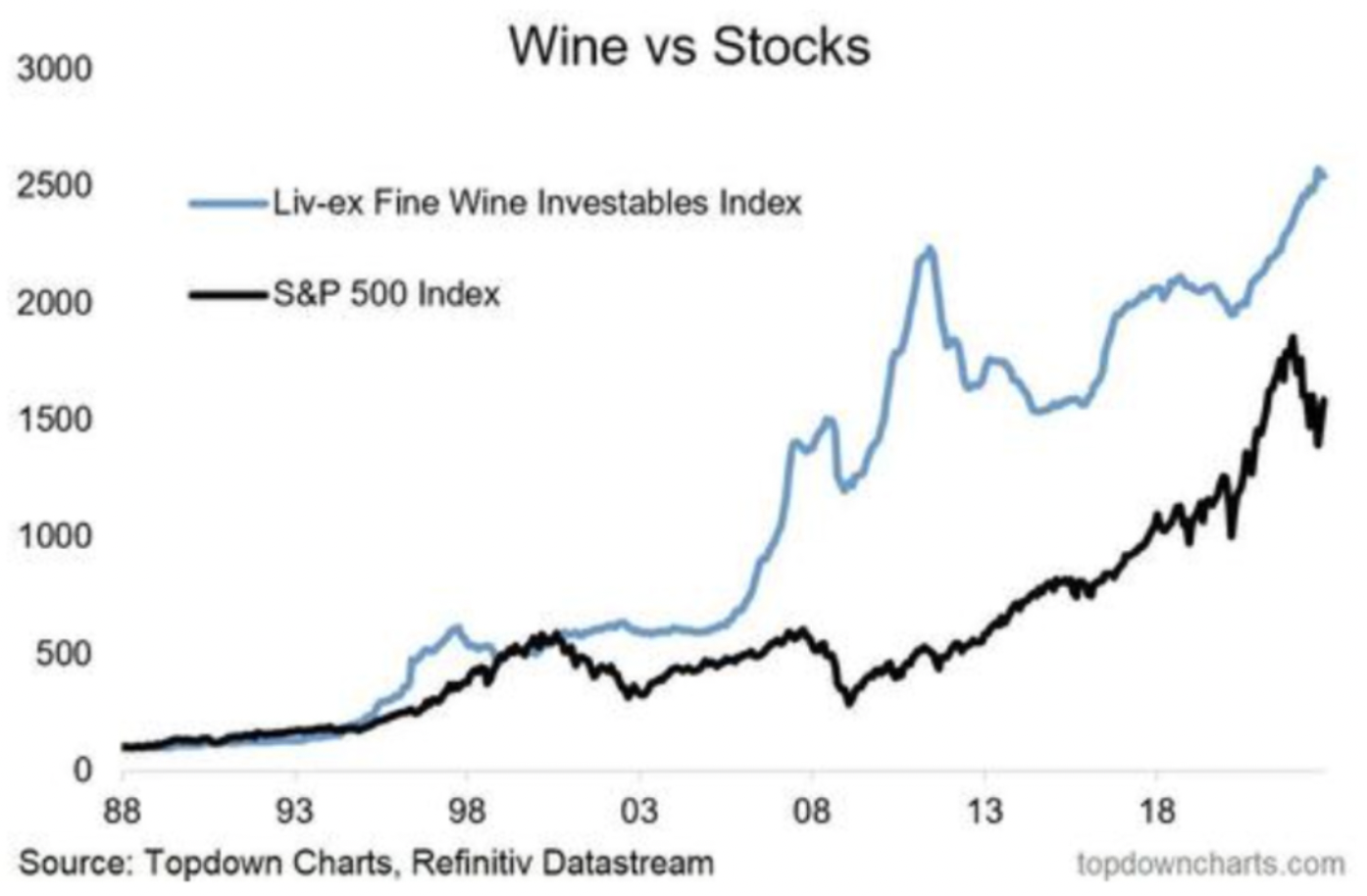

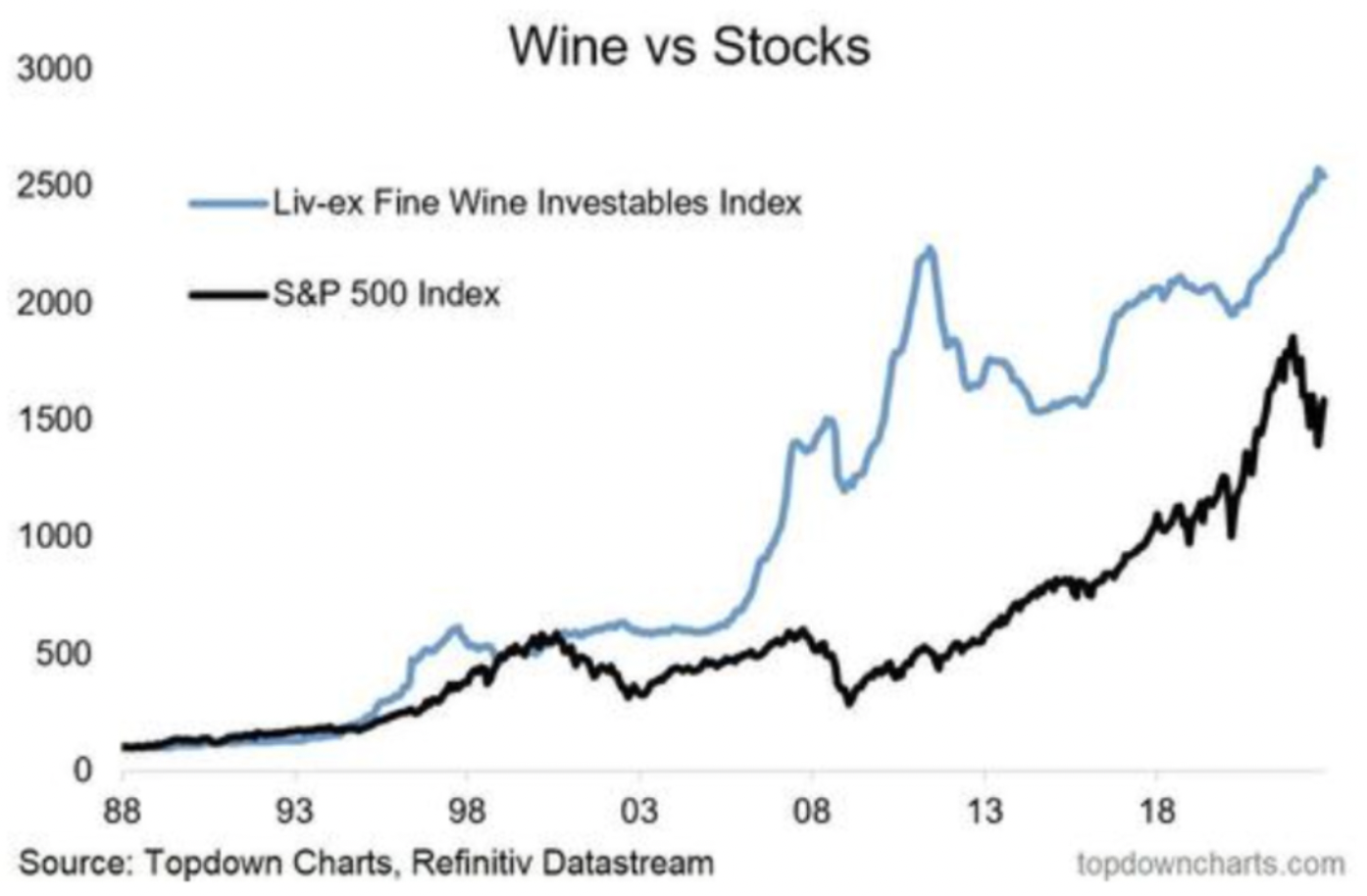

Last but not least, as a wine lover, I would recommend investing in the wine sector. You may not be a fan of it, but your wallet might start liking it. Especially if compared to the S&P 500. It seems to be one of the few alternative assets that knows no crisis.