Article by Ioannis Kantartzis, co-founder of TRADERS’ Magazine

Throughout his 25 years in the markets, trading, investing, educating and mentoring, there is one question that Ioannis Kantartzis, co-founder of TRADERS’ Magazine, has heard from aspiring young traders more than any other: “So, where do you think the markets are heading?” But Ioannis argues that understanding the essence of a great investment doesn’t lie in the ability to predict the future, but rather in the ability to adapt.

Using short term strategies and the same products as everyone else causes us to make the same mistake over and over: trying to predict a future which is inherently unpredictable. So how can traders take a different stance and adopt a view which is not zero-sum with binary results (up I win, down I lose)?

Options as a strategic investment

Much ink has been spilled as to the benefits of using options, essentially a combination of calls and puts. However, retail investors lacking in experience might easily be exposed to an even higher risk instead of mitigating it. Applied correctly, option strategies should put traders into a position where they can maximise the profit potential within certain levels while, at the same time, preventing them from levelling up their risk. In this context, I like to say “when you buy something, you’ve got to sell something” – effectively meaning you should be properly hedged at all times. Let me explain.

Selling volatility

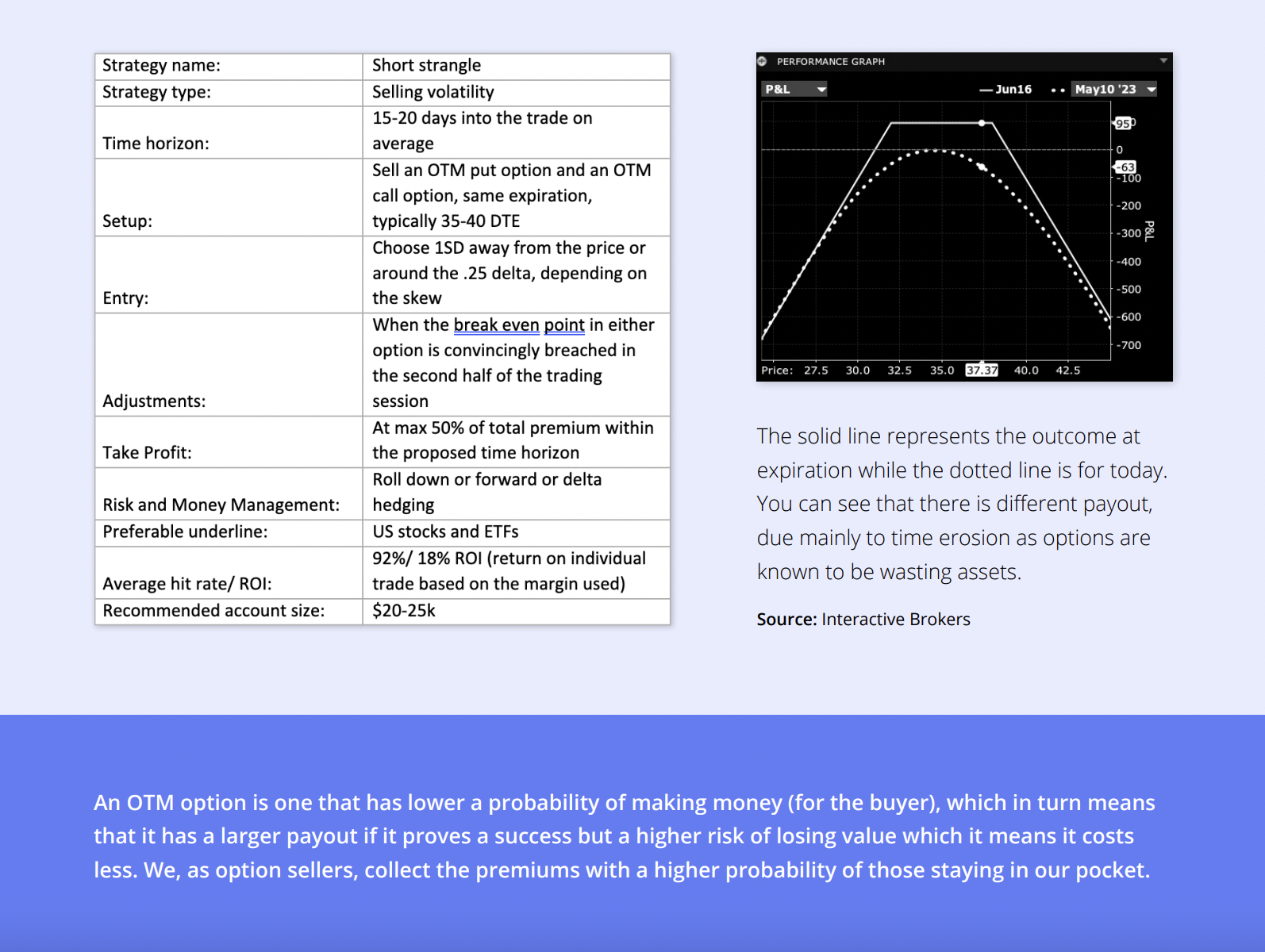

To avoid becoming an example of the 90/90/90 rule of thumb – according to which 90% of novice traders lose 90% of their money in just 90 days – one should follow a different approach and act like the insurer rather than the client. With that in mind, one of my favourite options strategies is selling volatility through a short strangle position. Don’t let the jargon get in the way, selling a ‘strangle’ means that I sell two types of options, one call and one put, at different out of the money (OTM) strikes but with the same expiration cycle.

Structuring the trade

In our case, key considerations are:

- Entry price: the total premium that I aim to collect

- Margin utilisation and ROI: target gains on the margin requirement

- Time in the position

- Exit rules: what is the maximum gain that my method demands

- Risk management rules: what if things do not turn out as expected?

Entry price

Selling two OTM options, a call and a put, means that one has to choose the correct strike price (the price at which the option is triggered for potential exercise). My methodology revolves around a clear set of rules according to which the strike chosen should be at least 1 standard deviation away from the current stock’s price. This level, more often than not, is around the 0.25 delta strike. Without getting into technical jargon, 1σ would mean that my position will have a 66% probability of making me money. The short strangle position makes money when the underline (be it a stock or an ETF in my case) stays until expiration in between the two sold strikes.

The strategy’s success is based on the model assumption that financial asset prices are mean reverting. This means that instead of moving in either direction in straight lines they tend to revert to their mean. Which, in turn, means that my position might be temporarily hurt by extreme short-term market fluctuations, but that they will revert to their mean most of the time, hence remaining within my short strikes and thus being profitable. This is exactly what differentiates options sellers from the crowd. The average investor tends to place directional bets which, if excessively leveraged, would leave them exposed to the implications of the market’s inherent short-term volatility, whereas informed investors aim at taking advantage of the majority’s lack of strategy.

Margin utilisation

I don’t just sell premiums for the sake of selling them though, I embark on a determined strategy – based on which I assume that the total of the two premiums that I can collect represents about 17-20% of return on investment from the margin utilised. In other words, obtaining a total premium of $1.8 (every option has the right to buy or sell 100 shares of the underline, so effectively $1.8 of premium means $180) should be on the basis of a margin requirement of no more than $1000.

Time in the position

I typically choose the expiration cycle which lies around 35 - 40 days ahead, as choosing shorter dated options would make me statistically vulnerable to more directional moves, offsetting time value benefits. I would open a trade with 35 days to expiration (DTE) and look to close it at around 20 DTE aiming at 50% of maximum gains. If they don’t materialise in time, I would be looking to adjust the trade in one of the following ways:

Exit rules

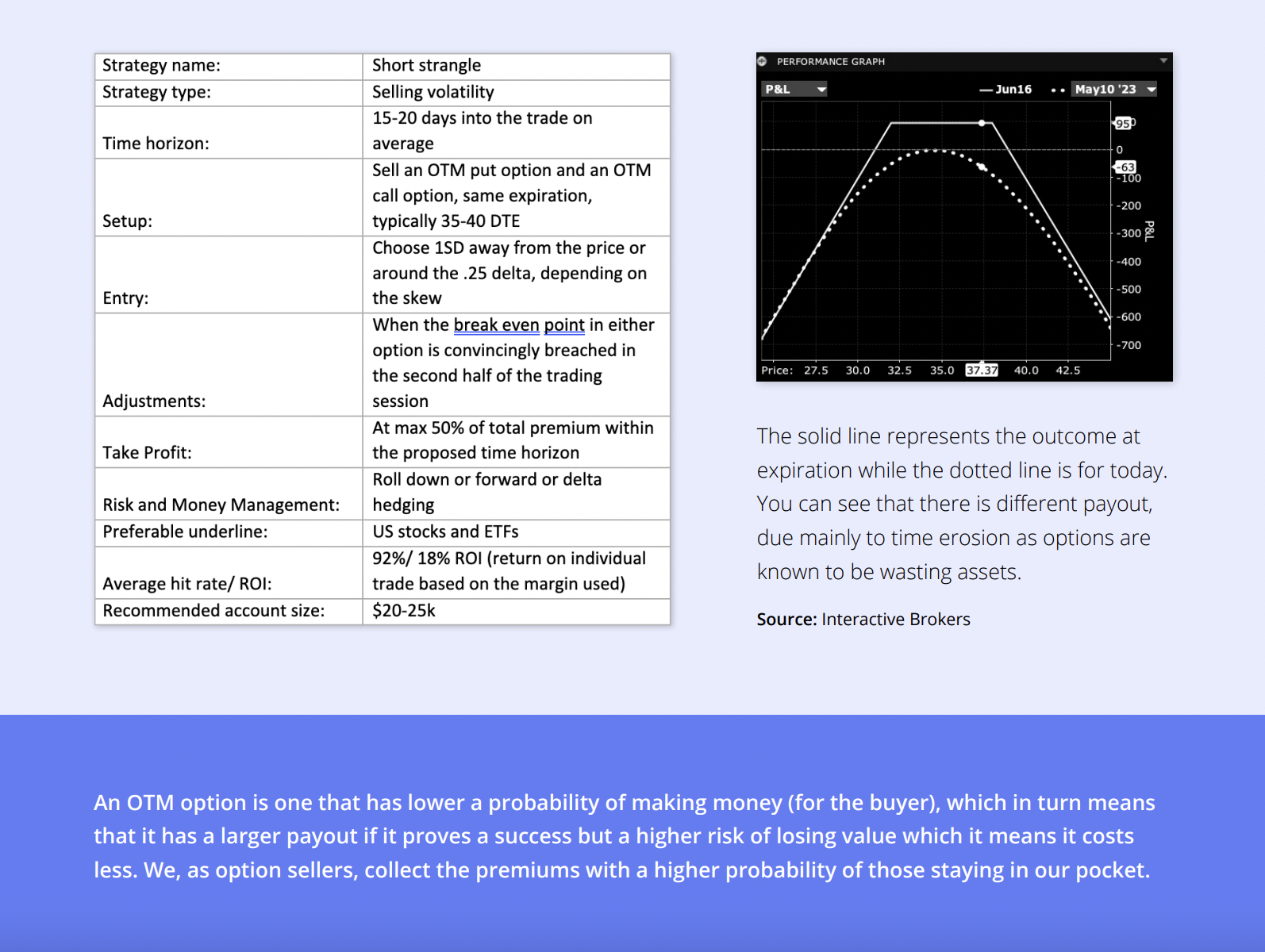

An option’s price can be very volatile, especially for the premium seller. Volatility, price skews and gamma exposure are just some of the nerve-wracking considerations in every trade. My personal preference would be to exit such short strangle trades at roughly 50% of the maximum gain (the maximum gain is always the total of the two premiums collected, provided the underlying stays within the two short strikes on expiration). One may speculate that prices will keep moving into the favoured direction after achieving 50% of the maximum gain, but good trading should be boring and consistent: where there is no plan, then there is no consistency either.

Risk management rules

Things do not always pan out as planned. While this strategy achieves a statistical hit rate of 92% (cp. mean reversion), the remaining 8% need to be adjusted with a clear set of rules. If a trade does not perform up until the 20 DTE, I need a set of adjustments. My first rule of thumb is that in order to adjust a position, it would mean that one of the two strikes is challenged (i.e., the underlying has moved against me either up or down). I only consider a leg adjustment when the break-even is convincingly breached within the second half of the trading session. As an example, if I’ve sold premiums to a total of $1.8 and the put strike of $105 is being breached, then my critical point is $105 - $1.8 = $103.2. Adjustments at that point would include either rolling forward to the next month, to gain time, or rolling to a lower strike to allow the underlying more room to move or perform what is called delta hedging (effectively zeroing out any future movement).

The above article and the opinions and ideas presented therein are solely those of the author and do not necessarily reflect those of Spectrum Markets. They are for informational and educational purposes only and neither represent a recommendation nor investment advice. Options trading involves significant risks and is not suitable for all investors.

Ioannis Kantartzis holds a BA Hons in Economics, an MSc in Money, Banking and Finance, a diploma in political and economic studies and relevant professional certifications, including options market making. He has over 25 years of experience in the financial markets as a high-profile executive, trainer and international speaker with an emphasis on options. He is co-founder of TRADERS' magazine in Spain.