Article by Giovanna Zanotti, Scientific Director, ACEPI

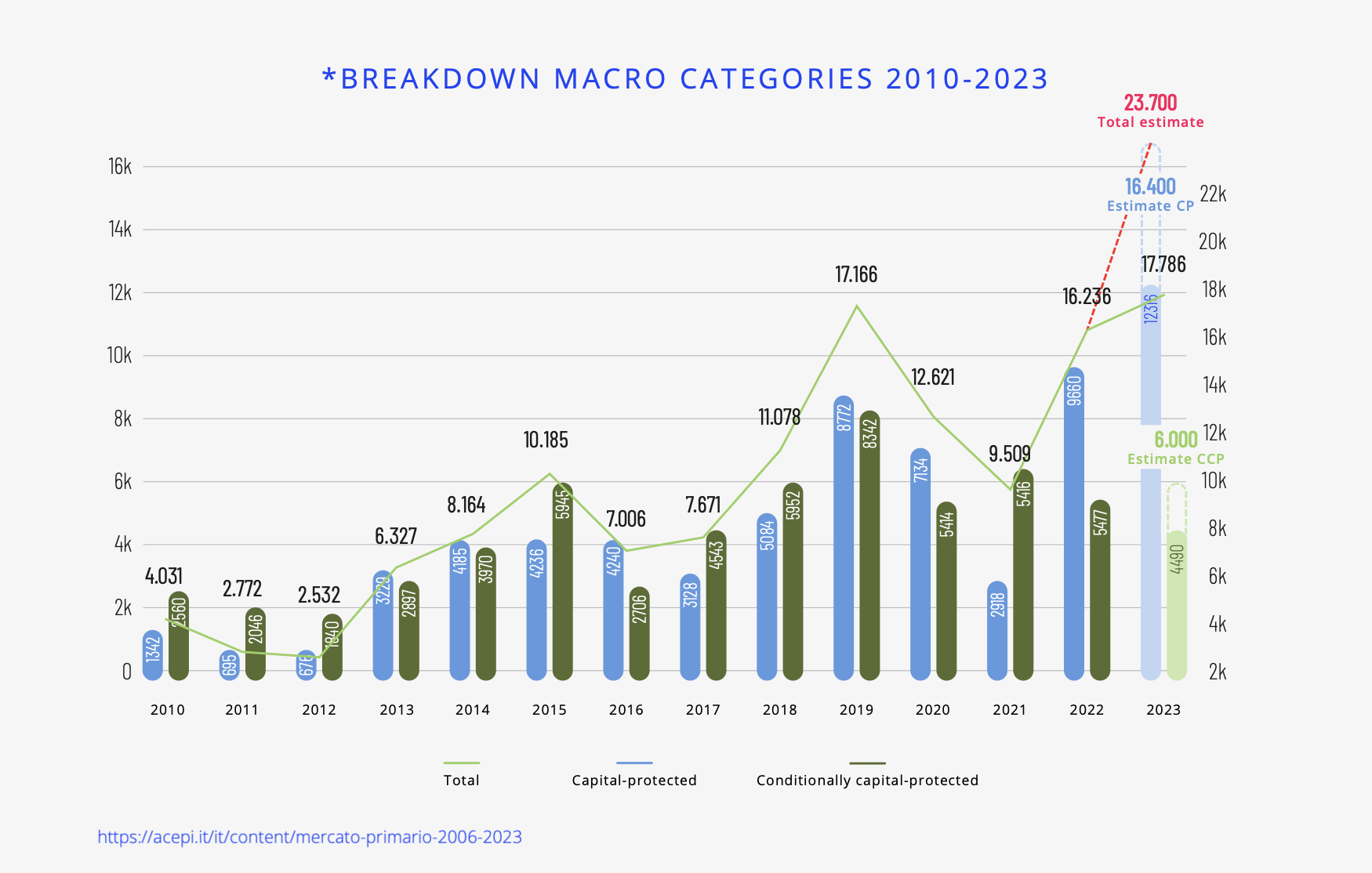

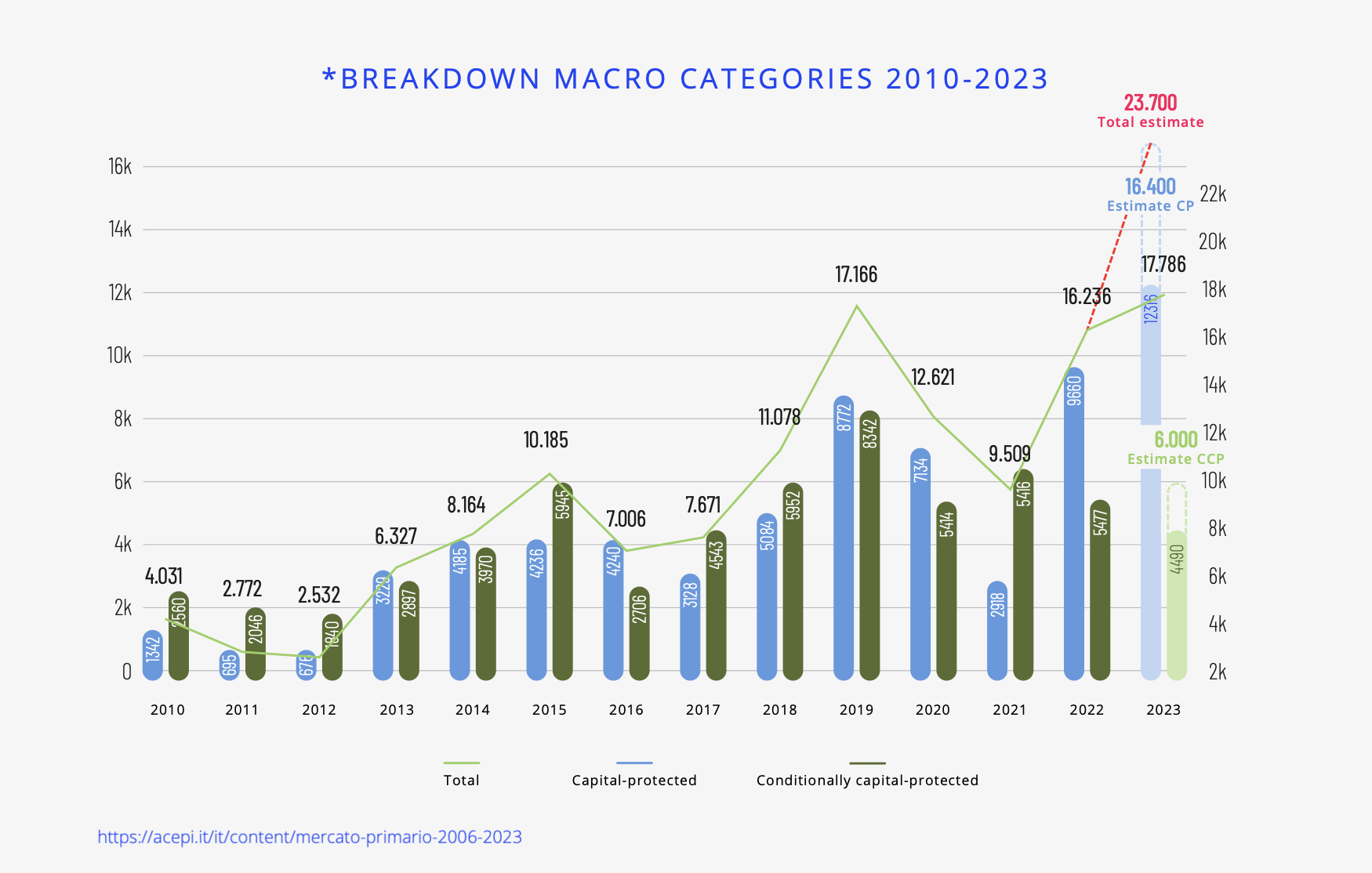

In a rising rate context, with retail investors looking back to fixed income in search of returns, the certificates industry has proven its ability to respond to challenges by providing compelling new solutions that could fit investors’ needs. This is reflected in the numbers: 2023 has been marked as a record year for certificates, surging from €16b issued in 2022 to more than €20b in 2023*.

Structured products represent an important part of investors’ portfolios, now being an asset class in their own right, and all the players operating in the industry are being called upon to play their part in shaping its evolution. In this dynamic and constantly progressing financial landscape, ACEPI, the Associazione dei Certificati e prodotti di investimento, has expanded its scope to include trading venues among its members and associates, highlighting their importance and unique perspective.

Spectrum Markets, with its distinctive pan-European experience and pioneering role in promoting innovation, proudly became the first MTF to join ACEPI. The association plays a key role in shaping the industry’s evolution, encouraging productive collaboration among its players, providing a point of reference and supporting useful initiatives. This is an important recognition and a step forward for Spectrum Markets, proving our dedication to fostering transparency, supporting retail investors and advocating for industry interests. We spoke to Giovanna Zanotti, Scientific Director of ACEPI, about the role of the association, and why Spectrum Markets’ membership is so significant.

What is ACEPI’s role on the Italian financial landscape and what impact does the association have on operators in the sector?

ACEPI was established in 2006, following the development of structured retail products in Italy. The primary aim of the association is to foster the sustainable development of the market through, among other things, financial education aimed at promoting an informed use of investment products, with a particular focus on certificates. ACEPI seeks to foster a constant dialogue between its members and regulatory bodies on issues related to market transparency and more generally on all topics of interest to the association and its members. We are active participants in regulatory panels and discussions, in coordination with other European associations.

Over the years, the association has consolidated its position as a point of reference for the main players in the Italian financial landscape, continuing to grow and welcoming as members and associates the most important players in the sector.

How are ACEPI’s activities and objectives realised?

Over the years, ACEPI has finalised a programme of activities in alignment with our commitment and growth aspirations. Operating as a meeting point for industry experts for almost two decades, ACEPI has been playing a central role organising studies, conferences and seminars, providing market operators with opportunities to stay informed about developments in the financial sector and investment products.

Research is the primary component of ACEPI’s programme, through the periodic monitoring of the domestic market (in terms of size and evolution) and the cataloguing of structured products in Italy. This activity not only provides a detailed overview of the market, but also contributes to a better and deeper understanding of structured products in the domestic context. Additionally, the association places a strong focus on financial education, creating informational material to promote awareness of certificates in Italy and organising training sessions for retail investors and networks, for example through free online courses accredited by EFPA and CFA SOCIETY ITALY.

ACEPI also prioritises the relational and communication aspect. In addition to managing a comprehensive web portal containing press reviews, product bibliographies, analyses and investment guides, the association organises several events featuring experts throughout the year, and actively collaborates with specialist media to produce technical articles, expanding the scope of its communication activities.

Looking at ACEPI’s reports, what is its assessment of the just-concluded year for the certificate market?

I would define 2023 as a very positive year for certificates. Drawing insights from the quarterly data provided by ACEPI-associated issuers, we have witnessed robust growth in both volumes and the number of certificates issued within the primary market. Notably, within the initial three quarters of 2023 these figures had already overcome the record placements achieved throughout the whole of 2022.

Putting it into perspective, in 2022, the certificate market reached its second-highest peak for placed certificates ever (following 2019), experiencing 71% year-on-year growth, and reaching €16,236m, while in the first three quarters of 2023, €17,786m were placed on the primary market—an additional 10% increase compared to the end of 2022.

In a macroeconomic environment like that of 2023, marked by sticky inflation and a sustained rise in interest rates, the main beneficiaries are typically expected to be bonds. How do you explain the resilience and growth of the certificate segment?

It is true that in an environment of restrictive monetary policies and with central banks adopting a less accommodating stance, the initial expectation would be a shift in interest towards bonds, seen as a particularly appealing investment instrument. While this has indeed occurred, it has not undermined the growth trajectory of certificates. On the contrary, rising interest rates fostered market growth by allowing issuers to structure products with shorter durations or higher yield potential.

The volumes placed as early as 2022 and in the first three quarters of 2023, therefore, underscore how investors have embraced investment opportunities linked to the equity and commodity markets, recognising in certificates financial structures capable of combining both yield and protection.

What typologies of certificates did investors prefer during this year? Were there differences compared to previous years?

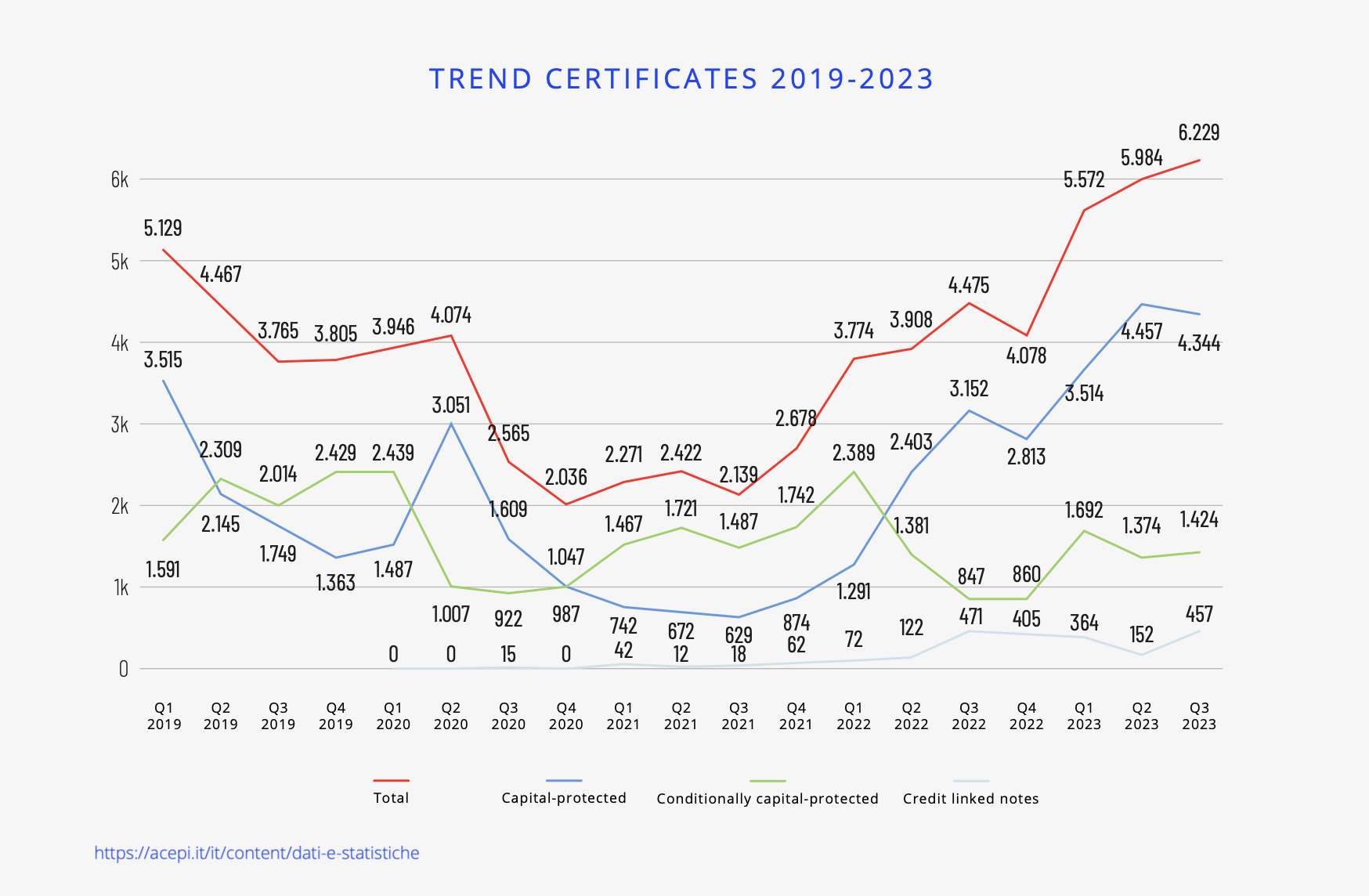

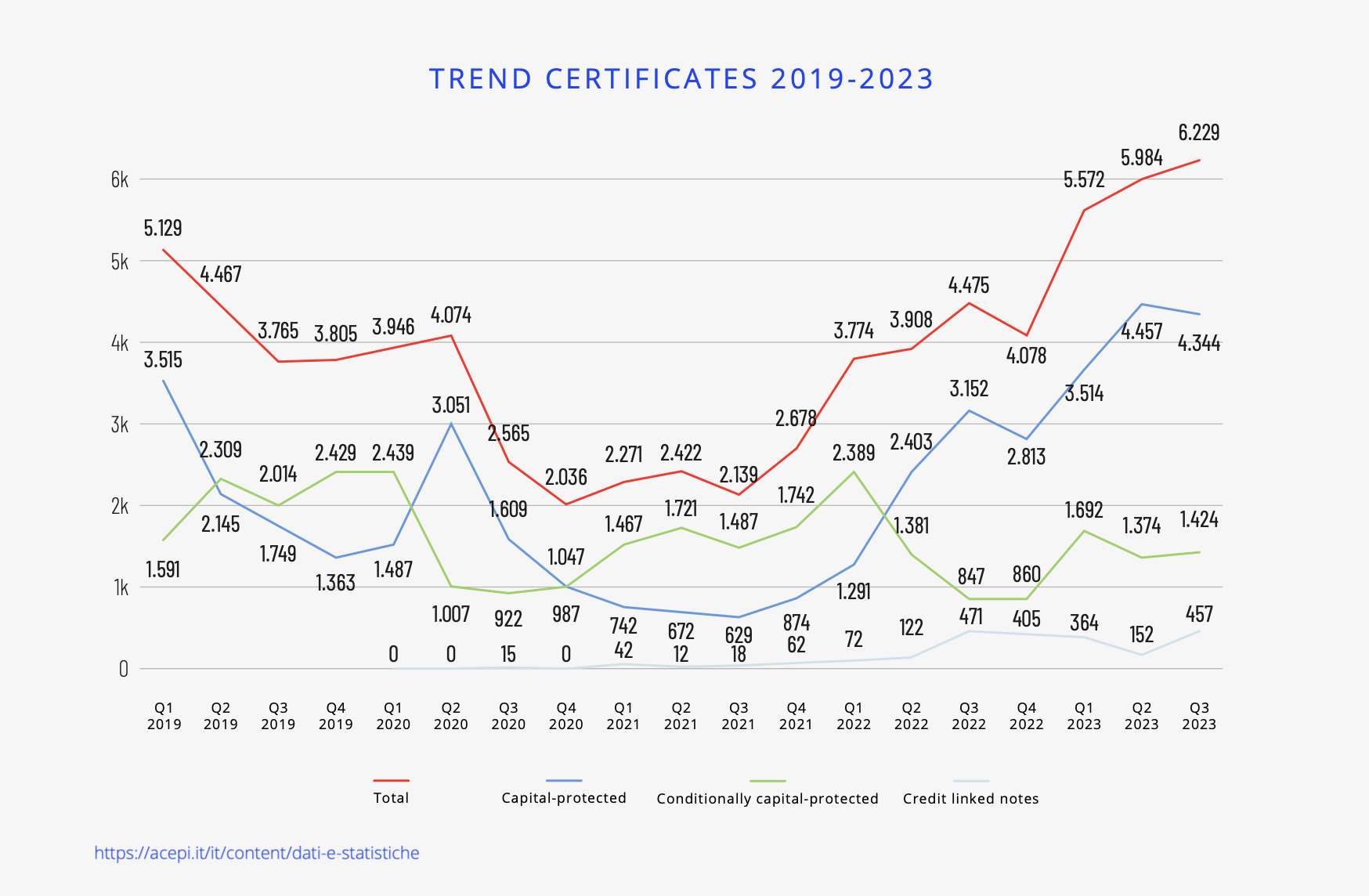

As illustrated in the graph, investors showed a distinct and sustained preference for capital protection products, a trend that has been notably pronounced since the second quarter of 2022. Throughout the first three quarters of the year, investors favoured capital-protected products (CP, 69%) over conditionally capital-protected products (CCP, 25%). The remaining 6% of the placed volume pertained to Credit Linked Notes, a product type that reached its peak at 11% and 10% of the total placed in Q3 and Q4 of 2022.

Graphically represented by the distance between the two curves (blue and green), the ratio between CCP and CP products effectively and concisely communicates investors’ risk appetite, which in turn reflects broader market trends. Analysing this trend reveals that 2021 was characterized by an increasing appetite for yield, culminating in a 71% preference versus 28% in Q2 2021. This trend shifted significantly in 2022, when there was a profound aversion to risk, hitting a low at the end of Q2 2023 with a 23% preference for CCP compared to 74% for capital-protected products.

Given the dynamism of the certificate market and its growth trajectory, how is ACEPI working to consolidate its central role in the sector and take advantage of the opportunities offered by this development?

Since its foundation, ACEPI has been actively committed to supporting a conscious and sustainable evolution of the certificate market. It is positive to witness how, in recent times, the surge in market data has been paralleled by the positive evolution of the association, both in terms of its activities and the increasing number of associates. Notably, we have recently welcomed three new members, including Spectrum Markets, which, as President Nicola Francia pointed out, introduce a different and innovative perspective that adds value to the initiatives already in place aimed at promoting the culture of and the informed use of certificates.

Furthermore, ACEPI’s commitment to bridging the gap between market participants and the world of certificates is clearly evident in our educational programme. Initially focused on a base course, the programme has evolved in response to the industry needs, now encompassing seven free online training courses targeted specifically at professionals such as financial advisors and private bankers. These courses cover different areas to deliver tailored and comprehensive training. They are focused on explaining how the maturity dynamics are pre-determined right from the issuance of the product, identifying the market variables that can influence secondary market prices and, importantly, guiding professionals on selecting optimal certificate types based on their market perspectives.

The growth in numbers and the expansion of ACEPI can only prosper in an environment where the market experiences sustainable growth, and where traders make conscious and accurate use of certificates. This ultimately underscores the ongoing commitment of our association: to ensure that the certificate industry evolves harmoniously with trader awareness and transparent investment practices.

The above article and the opinions and ideas presented therein are solely those of the author and do not necessarily reflect those of Spectrum Markets. Spectrum Markets shall not be held liable for any inaccuracies, misinformation or other information provided by the author. Nothing herein constitutes an offer to sell or a solicitation of an offer to purchase any financial instruments listed on Spectrum Markets or any product described herein. Spectrum Markets does not provide financial services, such as investment advice or investment brokering. Prospective retail investors can trade such products only with their brokers. The information herein does not constitute investment advice or an investment recommendation. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.